ASML’s Missed Net Bookings: A Potential Indicator of Slowing Demand for Chipmaking Machines

On Wednesday, Dutch semiconductor equipment manufacturer ASML Holding NV reported a missed net bookings expectation for the third quarter. This unexpected development has raised concerns about a potential slowdown in demand for ASML’s critical chipmaking machines. The stock price of ASML dropped by more than 5% in response to this news.

The Impact of Tariffs on the Semiconductor Industry

The semiconductor industry has been fragile over the last two weeks, with global chip stocks experiencing significant volatility. This instability can be attributed to growing worries about the potential impact of U.S. President Donald Trump’s tariff plans on the semiconductor supply chain.

Tariffs imposed on imports from China have already disrupted the supply chains of various industries, including technology. The semiconductor industry, in particular, is vulnerable to tariffs due to its reliance on complex global supply chains. Many semiconductor components are manufactured in Asia and then assembled in other parts of the world.

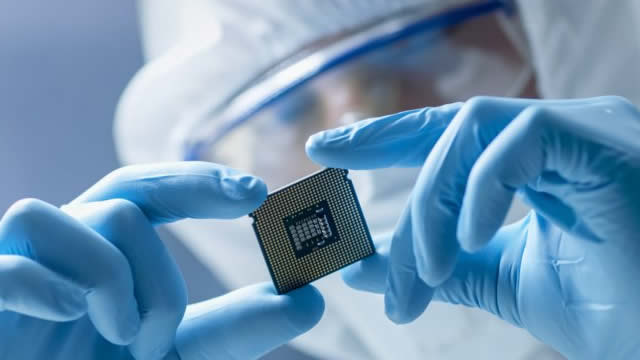

ASML’s Role in the Semiconductor Industry

ASML is a leading provider of photolithography equipment, which is essential for manufacturing semiconductors. The company’s machines are used to create the patterns on silicon wafers that form the basis of integrated circuits. ASML’s equipment is used by many of the world’s largest semiconductor manufacturers, including Intel, Samsung, and Taiwan Semiconductor Manufacturing Company (TSMC).

Implications for Consumers and the World

The potential slowdown in demand for ASML’s chipmaking machines could have significant implications for consumers and the world at large. Semiconductors are used in a wide range of products, from smartphones and laptops to cars and industrial equipment. A slowdown in semiconductor production could lead to supply shortages and higher prices for these products.

Moreover, the semiconductor industry is a major contributor to economic growth, particularly in countries like Taiwan and South Korea. A slowdown in demand for semiconductors could have ripple effects throughout the global economy.

Conclusion

ASML’s missed net bookings expectation is a concerning development for the semiconductor industry. The potential slowdown in demand for ASML’s chipmaking machines could be an early indicator of broader challenges facing the semiconductor supply chain. The impact of tariffs on the industry is a significant concern, and the situation is worth monitoring closely.

- ASML missed net bookings expectations for Q3, raising concerns about a potential slowdown in demand for chipmaking machines.

- Global chip stocks have been fragile over the last two weeks due to worries about the impact of tariffs on the semiconductor supply chain.

- ASML is a leading provider of photolithography equipment, essential for manufacturing semiconductors.

- A potential slowdown in semiconductor production could lead to supply shortages and higher prices for products that rely on semiconductors.

- The semiconductor industry is a major contributor to economic growth, particularly in countries like Taiwan and South Korea.

It is important to note that this analysis is based on current information and is subject to change. Further developments in the semiconductor industry and global trade policies could impact the situation.