The Upcoming Quarterly Results of Taiwan Semiconductor: A Crucial Moment for the Tech Industry

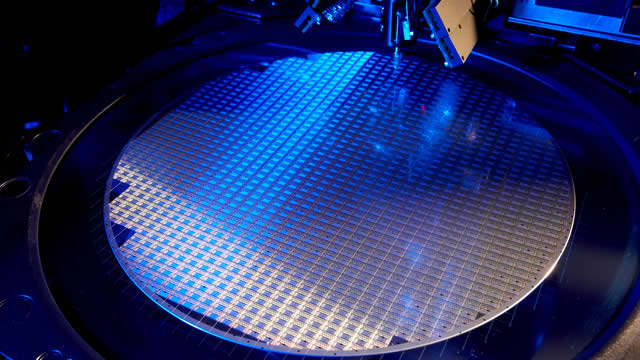

The tech industry is bracing itself for a significant event in the upcoming week. Taiwan Semiconductor Manufacturing Company Limited (TSMC), a leading semiconductor foundry, is set to announce its Q1 financial results on Thursday, April 17. As a key player in the global semiconductor market, responsible for producing approximately 50% of the world’s chip components, TSMC’s performance is closely monitored by investors and industry experts.

TSMC’s Role in the Semiconductor Market

TSMC’s dominance in the semiconductor industry is a result of its advanced manufacturing processes, which allow it to produce chips with smaller transistors and higher performance. This technological edge has made TSMC the go-to foundry for numerous tech giants, including Apple, AMD, and NVIDIA, among others. The company’s ability to meet the increasing demand for advanced chips, particularly in the areas of 5G, artificial intelligence (AI), and Internet of Things (IoT), is crucial for these companies’ success.

Impact on Wall Street

Wall Street has high expectations for TSMC’s Q1 results. The company’s revenue for Q4 2020 grew by 34% YoY, driven by strong demand for 5G and other advanced technologies. This impressive growth continued into Q1 2021, with TSMC reporting record-breaking orders from its clients. As a result, analysts are forecasting Q1 revenue of around $15.7 billion, representing a 28% increase YoY.

TSMC’s financial performance will be closely watched by investors, as it provides insights into the health of the broader tech industry. A strong quarterly report from TSMC could boost the stocks of its clients and other semiconductor companies, while a weak performance might lead to a sell-off. Additionally, any guidance provided by TSMC regarding future demand and production capacity could influence the tech sector’s overall trajectory.

Global Impact

TSMC’s Q1 results will also have far-reaching implications for the global economy. The semiconductor industry is a critical component of various sectors, including automotive, consumer electronics, and industrial automation. The ongoing chip shortage has already caused disruptions in these industries, and TSMC’s performance could provide insights into when the situation might improve.

Additionally, TSMC’s results could impact geopolitical tensions, particularly regarding the US-China technology race. The US government has been pushing for more domestic semiconductor production, and a weak TSMC performance might accelerate this trend. Conversely, strong results could reinforce TSMC’s position as a global leader in semiconductor manufacturing.

Conclusion

TSMC’s Q1 results on April 17 are a crucial moment for the tech industry and beyond. The company’s financial performance will provide insights into the health of the broader tech sector and the global economy. Moreover, any guidance provided by TSMC regarding future demand and production capacity could have significant implications for various industries and geopolitical tensions. As investors and industry experts eagerly await the announcement, the tech industry braces itself for the potential consequences.

- TSMC is a leading semiconductor foundry, producing approximately 50% of the world’s chip components.

- Wall Street closely monitors TSMC’s financial performance due to its impact on tech companies and the broader industry.

- TSMC’s Q1 results are forecasted to show strong growth, driven by demand for advanced chips in 5G, AI, and IoT.

- TSMC’s performance could influence the tech sector’s trajectory and the global economy.