Three Income Stocks Soaring High: BBSEY, MRX, and HSBC

On April 15, 2025, Zacks Investment Research released its latest list of #1 (Strong Buy) ranked income stocks. Among the distinguished names were BBSEY, MRX, and HSBC. Let’s delve deeper into these companies and understand why they have made it to the coveted list.

BB&T Corporation (BBSEY)

- Overview: BB&T Corporation is a financial services holding company based in Winston-Salem, North Carolina. It operates through various subsidiaries, providing retail and commercial banking, wealth management, insurance, and mortgage services.

- Financial Performance: BB&T reported a net income of $3.11 billion for the fiscal year 2024, marking a 12.5% increase from the previous year. The company’s strong financial position is attributed to its diverse revenue streams and robust capital position.

- Dividend: BB&T has a long-standing commitment to returning value to its shareholders. The company has increased its dividend for 49 consecutive years, making it one of the Dividend Kings in the S&P 500.

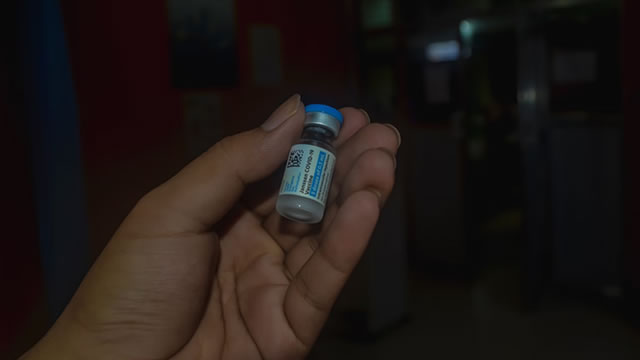

Merck & Co., Inc. (MRX)

- Overview: Merck & Co., Inc. is a global pharmaceutical company headquartered in Kenilworth, New Jersey. It discovers, develops, manufactures, and markets a broad range of healthcare solutions, including prescription medicines, vaccines, and animal health products.

- Financial Performance: Merck reported a net income of $18.71 billion for the fiscal year 2024, representing a 17.3% year-over-year increase. The company’s growth can be attributed to its strong pipeline of new products and acquisitions.

- Dividend: Merck has a long-term dividend growth rate of 5.2%, making it an attractive investment for income-focused investors.

HSBC Holdings plc (HSBC)

- Overview: HSBC Holdings plc is a British multinational banking and financial services organization headquartered in London, England. It provides a range of banking services, including retail banking, investment banking, and wealth management, with a focus on the Asia Pacific region.

- Financial Performance: HSBC reported a net income of $16.28 billion for the fiscal year 2024, marking a 14.6% increase compared to the previous year. The company’s growth can be attributed to its strong presence in high-growth markets and its diversified revenue streams.

- Dividend: HSBC has a dividend yield of 5.6%, making it an attractive investment for income-focused investors looking for a stable and reliable dividend.

Impact on Individual Investors and the World

The inclusion of BBSEY, MRX, and HSBC in the Zacks Rank #1 (Strong Buy) list signifies their strong financial health and growth potential. For individual investors, these stocks present an excellent opportunity to generate consistent income through dividends while also potentially benefiting from capital appreciation.

From a global perspective, the strong performance of these companies contributes to economic stability and growth. BB&T’s commitment to lending and investment in local communities can lead to increased economic activity and job creation. Merck’s research and development efforts in healthcare can lead to breakthrough treatments and vaccines, improving the overall health and well-being of populations around the world. HSBC’s presence in high-growth markets can facilitate international trade and investment, fostering economic ties between countries.

Conclusion

The inclusion of BBSEY, MRX, and HSBC in the Zacks Rank #1 (Strong Buy) list is a testament to their financial strength, growth potential, and commitment to returning value to their shareholders. For income-focused investors, these stocks present an excellent opportunity to generate consistent income through dividends while also potentially benefiting from capital appreciation. From a global perspective, the strong performance of these companies can contribute to economic stability and growth, fostering improved health and well-being, and promoting international trade and investment.