Navigating the Uncertainty: ASML and the Semiconductor Industry Brace for Trump’s Tariffs

The semiconductor industry is gearing up for another round of uncertainty as U.S. President Donald Trump is reportedly planning to impose tariffs on imported computer chip equipment. This announcement comes as Dutch company ASML Holding NV prepares to report its first-quarter earnings on Wednesday, April 21, 2021. The proposed tariffs have left investors seeking answers about the potential risks and implications for ASML and the broader semiconductor sector.

Background: ASML and the Semiconductor Industry

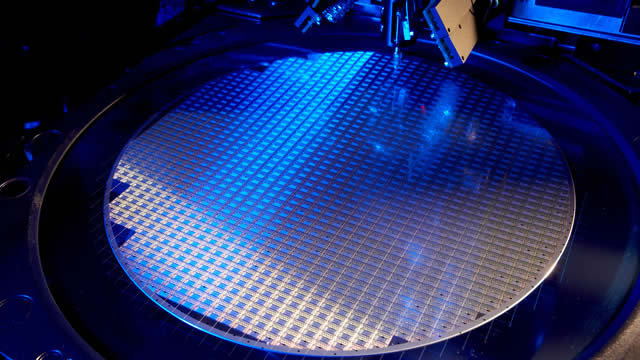

ASML is a leading global provider of photolithography equipment for the semiconductor industry. Its advanced technology is essential for manufacturing smaller, more complex chips found in smartphones, computers, and other electronic devices. With a significant portion of ASML’s manufacturing taking place in Europe, the potential tariffs could have a significant impact on the company’s operations and financial performance.

Impact on ASML: An Uncertain Future

The proposed tariffs could lead to increased production costs for ASML, as the company may be forced to pay additional taxes on imported equipment or source components domestically. This, in turn, could lead to higher prices for ASML’s products, potentially affecting its competitiveness in the market. Furthermore, tariffs could impact ASML’s ability to deliver its products on time, as supply chains may be disrupted. The uncertainty surrounding the tariffs could also negatively impact investor confidence in the company.

Global Implications: A Ripple Effect

The semiconductor industry is a global one, with a complex web of suppliers, manufacturers, and customers. The proposed tariffs on ASML’s equipment could have far-reaching implications for other companies in the sector. For instance, Intel, a major ASML customer, could face higher costs for purchasing equipment or be forced to find alternative suppliers. Additionally, other European semiconductor companies could be negatively affected if ASML’s operations are disrupted. Furthermore, the tariffs could lead to a trade war between the U.S. and its European allies, potentially damaging diplomatic relations and hindering international cooperation in technology development.

Looking Ahead: Uncharted Waters

As ASML prepares to report its first-quarter earnings, investors and industry analysts will be closely watching for any signs of the potential impact of the proposed tariffs. While the exact details of the tariffs have yet to be announced, the uncertainty surrounding them could continue to weigh on investor sentiment towards the semiconductor sector. In the meantime, companies in the sector, including ASML, may need to consider alternative strategies to mitigate the potential risks, such as diversifying their supply chains or exploring new manufacturing locations.

Stay tuned for further updates as more information becomes available.

Sources:

- Reuters: U.S. to propose tariffs on EU imports including semiconductor equipment – sources

- Bloomberg: ASML’s First-Quarter Earnings Preview: Tariffs, Demand and Capacity

- Semiconductor Industry Association: Semiconductors and Trade

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. Always consult with a financial professional before making investment decisions.

Conclusion: Treading Carefully in the World of Tariffs

The proposed tariffs on semiconductor equipment imported into the U.S. have left investors and industry analysts seeking clarity on the potential risks and implications for companies like ASML. With uncertainty surrounding the exact details of the tariffs, companies in the sector may need to consider alternative strategies to mitigate potential risks. The potential impact on ASML’s operations and financial performance, as well as the broader implications for the semiconductor industry, could be significant. Stay informed and stay tuned for further updates as more information becomes available.