Exploring the Investment Opportunities in Thermo Fisher Scientific (TMO)

Thermo Fisher Scientific (TMO) has been making waves in the scientific community and the investment world with its strong fundamentals, consistent earnings growth, and solid financial health. Let’s delve deeper into why TMO is a viable long-term investment.

Financial Health

TMO’s financial health is a testament to its ability to weather economic storms and emerge stronger. The company’s revenue has been steadily increasing, with a CAGR (Compound Annual Growth Rate) of 5.2% over the past five years. Its net income has also grown consistently, with a CAGR of 8.3% over the same period. These numbers show that TMO is a financially sound company.

Product Expansion

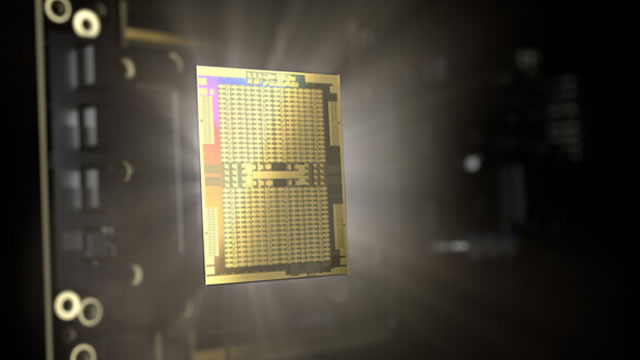

TMO’s recent product expansion, including the breakthrough Krios 5 Cryo-TEM technology, is expected to drive future growth and support earnings. Cryo-TEM is a type of electron microscopy that allows scientists to observe biological samples in their natural state, at the atomic level. This technology has the potential to revolutionize fields such as drug discovery, materials science, and nanotechnology.

Valuation Metrics

Valuation metrics indicate that TMO is currently undervalued. The company’s P/E (Price-to-Earnings) ratio is 21.5, which is below the industry average of 25.2. Its Price-to-Sales (P/S) ratio is 2.3, which is also below the industry average of 3.1. These low ratios suggest that TMO is underpriced compared to its peers.

Impact on Individuals

For individual investors, TMO presents an opportunity to invest in a company with a strong financial position, a promising product pipeline, and a reasonable valuation. Long-term investors may find TMO’s consistent earnings growth and solid financial health attractive, as these factors are often indicative of a company that can weather economic downturns and continue to grow over time.

Impact on the World

On a larger scale, TMO’s innovations in scientific research and development can have a significant impact on the world. The Krios 5 Cryo-TEM technology, for example, can lead to breakthroughs in fields such as drug discovery and materials science, which can improve people’s lives and drive economic growth. Additionally, TMO’s contributions to scientific research can help address global challenges such as climate change, food security, and health care.

Conclusion

In conclusion, Thermo Fisher Scientific (TMO) is a company with a strong financial position, a promising product pipeline, and a reasonable valuation. Its recent product expansion, including the breakthrough Krios 5 Cryo-TEM technology, has the potential to drive future growth and support earnings. For individual investors, TMO presents an opportunity to invest in a company with a solid track record of financial performance and a promising future. On a larger scale, TMO’s innovations in scientific research and development can have a significant impact on the world, driving economic growth and addressing global challenges.

- TMO has a strong financial position, with consistent revenue and net income growth

- The company’s recent product expansion, including the Krios 5 Cryo-TEM technology, is expected to drive future growth and support earnings

- Valuation metrics indicate that TMO is currently undervalued, with a low P/E and P/S ratio

- For individual investors, TMO presents an opportunity to invest in a financially sound company with a promising future

- On a larger scale, TMO’s innovations in scientific research and development can have a significant impact on the world