Caledonia Mining Corporation’s Sale of Solar Plant: An Examination

Caledonia Mining Corporation PLC (AIM:CMCL, NYSE-A:CMCL), a mining company renowned for its operations in Zimbabwe, has recently announced the completion of a significant transaction. The corporation has sold its subsidiary, which owns and manages a 12.2MWac solar plant, for the sum of $22.35 million.

Background on the Solar Plant

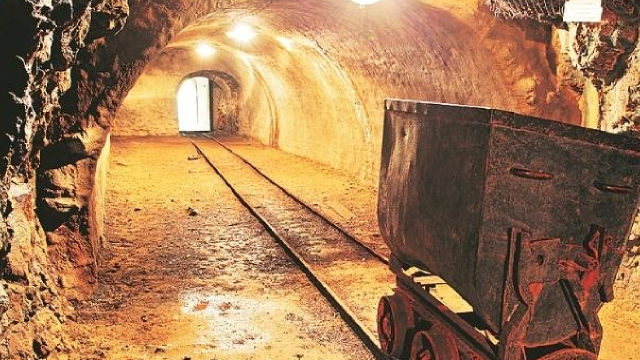

The solar plant, located near the Blanket Mine in Zimbabwe, has been an integral part of the mining company’s operations since its inception. Under an exclusive power purchase agreement, the solar plant supplies electricity to the Blanket Mine to support its gold production.

Financial Implications

The sale of the solar subsidiary represents a substantial injection of cash for Caledonia Mining Corporation. With the proceeds from this transaction, the company can explore various opportunities, such as expanding its mining operations or investing in research and development. This move aligns with the corporation’s strategic goal of maximizing shareholder value.

Impact on the Blanket Mine

Although the ownership of the solar plant has changed hands, the power purchase agreement remains in place. As a result, the Blanket Mine will continue to receive a reliable and sustainable source of electricity to fuel its gold production. This consistency is crucial for the mine’s operations and the overall financial performance of Caledonia Mining Corporation.

Global Perspective

The sale of Caledonia Mining Corporation’s solar plant is a testament to the growing trend of renewable energy adoption in the mining sector. With increasing global focus on reducing carbon emissions and transitioning to cleaner energy sources, the mining industry is following suit. This shift not only benefits the environment but also allows mining companies to reduce their reliance on traditional energy sources and secure more stable energy costs.

Personal Impact

Individuals who invest in Caledonia Mining Corporation may see positive impacts from this transaction. The infusion of cash can lead to potential growth opportunities for the company, which could translate into increased share value. Additionally, the continued operation of the solar plant at the Blanket Mine ensures a stable energy supply for the mine, contributing to its ongoing success.

Conclusion

Caledonia Mining Corporation’s sale of its solar plant for $22.35 million marks a strategic move in the company’s quest to maximize shareholder value. The transaction’s financial implications extend beyond the corporation, as the mining industry increasingly adopts renewable energy sources to reduce carbon emissions and secure stable energy costs. With the power purchase agreement intact, the Blanket Mine will continue to receive a reliable source of electricity, ensuring its gold production remains strong. Overall, this transaction signifies a pivotal moment in the mining sector’s transition towards a more sustainable energy future.

- Caledonia Mining Corporation sells solar subsidiary for $22.35 million

- Solar plant continues to supply power to Blanket Mine under a PPA

- Infusion of cash for potential growth opportunities

- Renewable energy adoption in the mining sector

- Stable energy supply for the Blanket Mine

- Significant moment in the mining sector’s transition towards sustainable energy