Investment Analysis: PPL’s Current Stock Situation

Power and Utilities Corporation (PPL), a leading energy company, has been making headlines with its rising estimates and systematic expenditure to strengthen operations. However, despite these positive indicators, our analysis suggests a cautious approach for potential investors.

Financial Performance

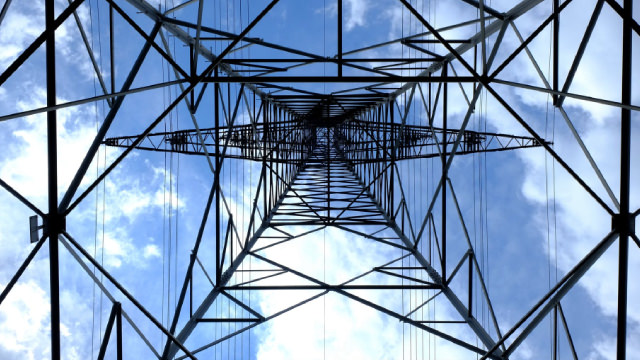

PPL’s financial performance has been commendable, with consistent revenue growth and a strong balance sheet. The company has reported impressive earnings in recent quarters, driven by higher electricity sales and cost savings initiatives. Furthermore, PPL’s management has announced plans to invest heavily in infrastructure upgrades and renewable energy projects.

Valuation

Despite these positive developments, the stock is currently trading at a premium. The price-to-earnings ratio (P/E) is above the industry average, indicating that the market may be overvaluing the stock. Moreover, PPL’s price-to-book ratio (P/B) is also higher than its historical average, suggesting that the stock may be overpriced based on its book value.

Economic Factors

Economic factors also play a role in PPL’s current valuation. The energy sector has been on an upward trend, with increasing demand for electricity and natural gas. However, this trend may not continue indefinitely, as economic conditions and regulatory policies can significantly impact the sector. For instance, any changes in government regulations regarding carbon emissions or renewable energy subsidies could negatively impact PPL’s profitability and, consequently, its stock price.

Impact on Individual Investors

- If you are an individual investor considering purchasing PPL stock, it may be prudent to wait for a better entry point. This could mean observing the stock price for some time or looking for a dip in the market.

- You may also want to consider diversifying your portfolio by investing in other sectors or companies to mitigate the risk of relying too heavily on PPL’s performance.

Impact on the World

PPL’s financial situation and stock performance can have far-reaching consequences. For instance, if the company experiences significant growth, it could lead to increased employment opportunities and economic development in the areas where it operates. Conversely, if PPL’s stock price drops, it could negatively impact investor confidence and potentially lead to a ripple effect in the broader market.

Conclusion

In conclusion, while PPL’s financial performance and operational improvements are noteworthy, the current stock valuation suggests a cautious approach for potential investors. Given the economic factors and regulatory uncertainties, it may be wise to wait for a better entry point before investing in PPL stock. As always, it is essential to conduct thorough research and consult with financial advisors before making investment decisions.