Nvidia Corporation: A Long-Term Trade Opportunity Amidst Volatility

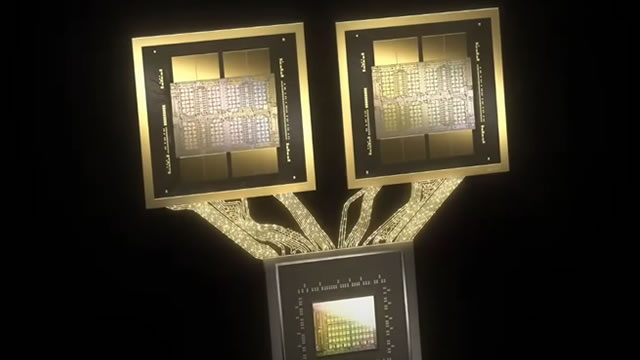

Nvidia Corporation (NVDA), a leading technology company specializing in graphic processing units (GPUs) and system-on-chip units for the gaming and professional markets, has experienced a sell-off in recent months. However, a closer look at the company’s fundamentals and technicals indicates that this downturn presents a buying opportunity for investors, with the potential for significant upside towards $300 by 2025.

Strong Fundamentals

Despite the sell-off, Nvidia’s fundamentals remain solid. The company has reported consistent revenue growth, driven by the demand for GPUs in gaming, data centers, and automotive markets. In fact, Nvidia’s data center segment has been a major growth driver, with revenue increasing by 67% year-over-year in Q1 2023. Additionally, the company’s gross margins have remained stable, and its net income has continued to grow.

Technical Analysis

From a technical perspective, Nvidia’s sell-off appears to be the result of market volatility and overextended positioning. However, recent price action suggests that the stock may have found a bottom. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators have both shown bullish signals, indicating that the stock may be poised for a rally. Furthermore, key support levels around $65 have held, limiting downside risk.

Upcoming Catalysts

Several upcoming catalysts could further boost Nvidia’s stock price. These include the release of new gaming GPUs, continued growth in the data center segment, and potential expansion into the autonomous vehicle market. Additionally, the company’s partnership with Microsoft (MSFT) to develop next-generation gaming consoles could provide a significant boost to its revenue and stock price.

Impact on Individual Investors

For individual investors, Nvidia’s strong fundamentals and potential for significant upside make it an attractive long-term investment opportunity. However, it is important to note that investing in individual stocks carries risk, and investors should consider their own risk tolerance and investment goals before making a decision.

Impact on the World

From a broader perspective, Nvidia’s potential rally could have significant implications for the technology sector and the global economy. The company’s innovative technologies are driving advancements in gaming, data centers, and autonomous vehicles, and its success could lead to further growth and innovation in these areas. Additionally, Nvidia’s partnerships with major tech companies like Microsoft and Tesla could accelerate the adoption of these technologies on a global scale.

Conclusion

In conclusion, Nvidia Corporation’s recent sell-off presents a buying opportunity for long-term investors, with strong fundamentals and technicals supporting a potential rally towards $300 by 2025. While market volatility and overextended positioning have contributed to the sell-off, the company’s solid financials, innovative technologies, and upcoming catalysts make it an attractive investment opportunity. For individual investors, it is important to consider their own risk tolerance and investment goals before making a decision. From a broader perspective, Nvidia’s success could have significant implications for the technology sector and the global economy, driving further growth and innovation in gaming, data centers, and autonomous vehicles.

- Nvidia Corporation’s sell-off presents a buying opportunity for long-term investors

- Strong fundamentals, including consistent revenue growth and stable gross margins

- Technical analysis suggests limited downside risk and potential for significant upside

- Upcoming catalysts, including new gaming GPUs and expansion into the autonomous vehicle market

- Impact on individual investors: attractive long-term investment opportunity

- Impact on the world: driving further growth and innovation in technology sector