Intel’s Selling of Altera: A Game-Changer in the Semiconductor Industry

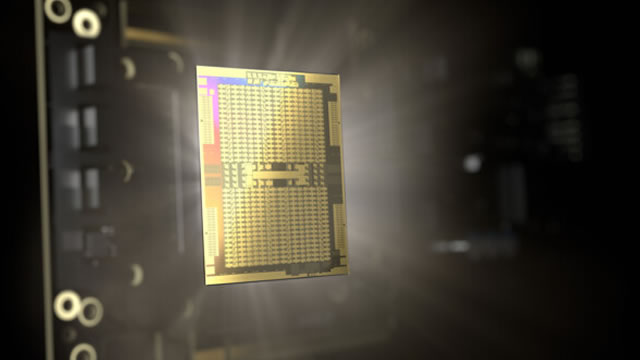

Intel, the world’s largest chipmaker, announced on Monday its intention to sell a 51% stake in Altera, its programmable chip unit, to Silver Lake, a leading technology investment firm. Valued at a whopping $8.75 billion, this transaction marks a significant shift in Intel’s business strategy.

Intel’s Decision: A Closer Look

Intel’s decision to sell a major stake in Altera comes after a series of strategic moves aimed at refocusing its business on core areas. The sale is expected to generate substantial cash for Intel, which can be used to fund research and development efforts, pay down debt, or make acquisitions.

Silver Lake’s Role

Silver Lake, known for its successful investments in technology companies, will bring valuable expertise and resources to Altera. The private equity firm’s involvement could lead to operational improvements, cost savings, and potential growth opportunities for the programmable chip unit.

Impact on the Semiconductor Industry

The Intel-Altera deal is likely to have far-reaching implications for the semiconductor industry. For one, it underscores the ongoing trend of consolidation and specialization, as companies focus on their core competencies and seek to streamline their operations.

- Competition: The sale could intensify competition in the programmable chip market, as Intel’s competitors may see an opportunity to expand their market share.

- Innovation: The transaction could lead to increased innovation, as Altera, now under Silver Lake’s ownership, may be more agile and responsive to market demands.

- Investment: The deal could also attract more investment in the programmable chip sector, as other companies may see potential opportunities for growth and expansion.

Personal and Global Implications

The Intel-Altera deal may have both personal and global implications for consumers and businesses. For individuals, this could mean access to more advanced and efficient technologies, as companies continue to innovate and improve their offerings.

On a global scale, the transaction could contribute to economic growth and job creation, as the semiconductor industry remains a key driver of innovation and technological progress. Additionally, the increased competition and innovation could lead to lower prices and improved performance for consumers.

Conclusion

Intel’s decision to sell a major stake in Altera to Silver Lake represents a significant shift in the semiconductor industry. The transaction could lead to increased competition, innovation, and investment in the programmable chip sector, while also providing Intel with substantial cash to fund future initiatives. As the industry continues to evolve, it is essential to stay informed about these developments and their potential implications.

Stay tuned for more updates on this developing story.