Tesla’s 2025 Slump: A Combination of Rising Competition and Political Pressure

Tesla (TSLA), the trailblazing electric vehicle (EV) manufacturer, has been one of the worst-performing megacap stocks in 2025. With shares down by a staggering 28% year to date, Tesla’s stock price stands in stark contrast to the S&P 500’s decline of a more modest 7% over the same period. This slide in Tesla’s stock price is a result of a perfect storm of challenges, including rising competition and political pressure.

Rising Competition:

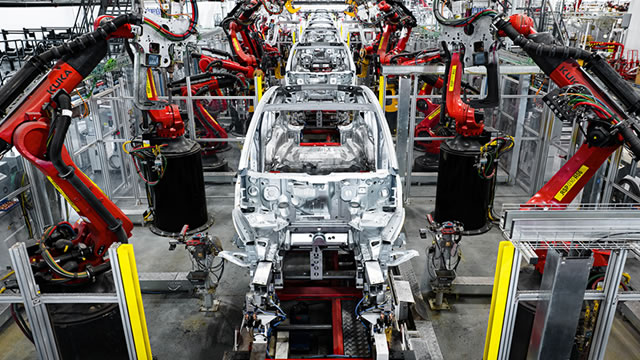

The EV market is becoming increasingly competitive, with traditional automakers like General Motors and Ford ramping up their electric vehicle production. These companies, which have decades of experience in the automotive industry, are bringing competitive pricing, improved range, and advanced features to the table. For instance, GM’s new Bolt EUV has a starting price of $31,995, undercutting the Tesla Model 3’s base price of $36,990. This competition is putting pressure on Tesla to maintain its market leadership and innovate to stay ahead.

Political Pressure:

Tesla is also facing political pressure that is calling its persistently high valuation into question. In the United States, the Biden administration has proposed a $150 billion investment in electric vehicles as part of the infrastructure bill. This investment is expected to boost the production and adoption of EVs, potentially benefiting traditional automakers and startups like Rivian and Lucid Motors more than Tesla. Additionally, Tesla’s CEO, Elon Musk, has been under scrutiny for his handling of the company’s SolarCity business, which has led to investigations and calls for increased transparency.

Impact on Individual Investors:

For individual investors, Tesla’s 2025 slump could mean significant losses if they have a large position in the company’s stock. However, it also presents an opportunity to buy at a lower price and potentially profit from a potential rebound. It is essential for investors to closely monitor Tesla’s financial performance, competitive landscape, and regulatory environment to make informed decisions.

Impact on the World:

Tesla’s struggles could have far-reaching implications for the EV industry and the world at large. If Tesla’s stock price continues to decline, it could dampen investor enthusiasm for EVs and slow the pace of adoption. On the other hand, increased competition and political pressure could force Tesla to innovate and improve its offerings, driving the EV market forward. Ultimately, Tesla’s challenges are a reminder that even the most innovative companies face significant competition and regulatory hurdles.

Conclusion:

Tesla’s 2025 slump is a result of a perfect storm of challenges, including rising competition and political pressure. For individual investors, this presents both risks and opportunities. For the world, Tesla’s struggles could have far-reaching implications for the EV industry and the pace of adoption. Regardless of the outcome, it is essential for investors and stakeholders to closely monitor Tesla’s financial performance, competitive landscape, and regulatory environment to make informed decisions.

- Tesla’s stock price has declined by 28% year to date, significantly underperforming the S&P 500’s decline of 7%.

- Rising competition from traditional automakers is putting pressure on Tesla to maintain its market leadership.

- Political pressure, including investigations into Tesla’s CEO and the Biden administration’s proposed EV investment, is calling Tesla’s persistently high valuation into question.

- Individual investors could experience significant losses or profit opportunities depending on the outcome.

- Tesla’s struggles could have far-reaching implications for the EV industry and the pace of adoption.