Micron’s Tariff Woes: A Delicate Balance of Semiconductors and Trade Policies

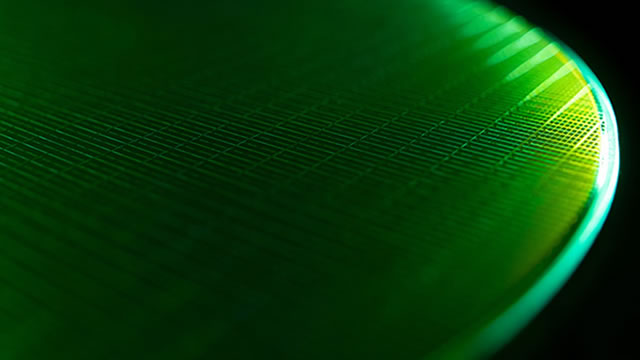

Micron Technology, Inc. (MU) is a leading global manufacturer and provider of semiconductor solutions. While its microchips have managed to dodge the Trump administration’s tariffs, the same cannot be said for its other business segments.

Micron’s Exposed Business Segments

Micron’s business involves more than just microchips. The company also produces memory modules and solid-state drive (SSD) equipment, which are not exempt from the tariffs. This means that a significant portion of Micron’s revenue is at risk.

Impact on Micron: A Financial Perspective

The tariffs could lead to increased production costs for Micron, as the company may be forced to pay higher prices for raw materials and components sourced from China. This, in turn, could lead to lower profit margins and reduced competitiveness in the market.

Impact on Consumers: A Personal Perspective

As a consumer, you might not feel the immediate impact of Micron’s tariff-related woes. However, the increased costs for Micron could eventually translate into higher prices for the end consumer. This could be particularly pronounced in markets where Micron has a significant market share, such as the memory and storage markets.

Impact on the World: A Global Perspective

The tariffs could have far-reaching implications for the global semiconductor industry. Micron is not the only company with significant exposure to both tariffed and tariff-exempt semiconductor products. Other companies, including Intel and Samsung, could also be affected.

A Delicate Balance

The situation is further complicated by the fact that memory modules and SSD equipment are used in a wide range of products, from smartphones and laptops to servers and data centers. This makes it difficult to predict the exact impact of the tariffs on any one industry or market.

Conclusion: Navigating the Complexities of Trade Policies

Micron’s tariff exposure serves as a reminder of the complexities of modern trade policies. While the tariffs on microchips have received a lot of attention, it’s important to remember that other business segments can also be significantly impacted. As a consumer, it’s crucial to stay informed about these developments and consider the potential implications for the products and services you use.

- Micron’s business involves more than just microchips

- Memory modules and SSD equipment are not tariff-exempt

- Increased production costs could lead to lower profit margins and reduced competitiveness

- Higher costs for Micron could eventually translate into higher prices for consumers

- The tariffs could have far-reaching implications for the global semiconductor industry