ASML’s Recent Stock Movement and Earnings Estimate Revisions

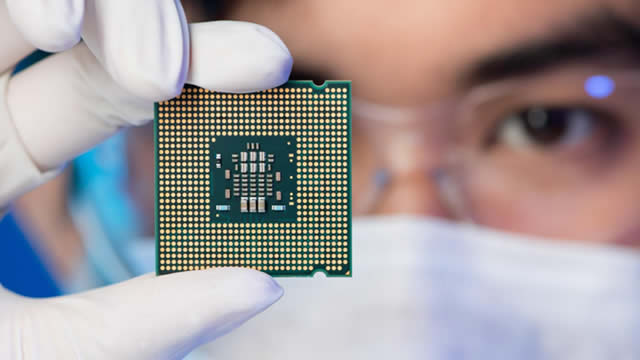

ASML (ASML), a leading global supplier of photolithography equipment for the semiconductor industry, experienced significant stock movement in the last trading session. The stock price saw a notable increase, trading at higher-than-average volumes. This surge in ASML’s stock price might have caught the attention of many investors, but a closer look at the latest trends in earnings estimate revisions may provide some insight into the stock’s potential future direction.

Impact on ASML

Although ASML has reported impressive financial results in recent quarters, the trend in earnings estimate revisions has been downward. Analysts have been revising their earnings estimates for ASML lower over the past few weeks. This could be due to several reasons, including increased competition, macroeconomic concerns, or supply chain disruptions.

A decrease in earnings estimates can often lead to a negative reaction from the market, potentially causing a stock’s price to decline. In the case of ASML, this trend could be a cause for concern for investors who have recently bought the stock or were considering doing so. It’s essential to keep in mind that earnings estimate revisions are just one factor among many that can influence a stock’s price.

Impact on Individual Investors

For individual investors, the recent stock movement and earnings estimate revisions for ASML could mean different things. Those who hold ASML stock may be worried about the potential for a price decrease, while those considering purchasing the stock might be hesitant due to the downward trend in earnings estimates.

It’s essential to remember that investing always carries risk, and the stock market can be unpredictable. Individual investors should consider their investment goals, risk tolerance, and investment horizon before making any decisions regarding ASML or any other stock. Diversification is also crucial, as investing in a single stock can be risky.

Impact on the World

The semiconductor industry, including companies like ASML, plays a vital role in the global economy. The trend in earnings estimate revisions for ASML could potentially have broader implications. A decrease in earnings estimates for a leading semiconductor equipment supplier could be a sign of broader concerns within the industry.

The semiconductor industry is a key driver of innovation and technological advancements, and its health can impact various sectors, including technology, automotive, healthcare, and consumer electronics. A potential decline in the semiconductor industry could have ripple effects on other industries and the global economy as a whole.

Conclusion

ASML’s recent stock movement and the downward trend in earnings estimate revisions are important factors for investors to consider. While a decrease in earnings estimates can be a cause for concern, it’s essential to remember that the stock market can be unpredictable, and various factors can influence a stock’s price. Individual investors should consider their investment goals, risk tolerance, and investment horizon before making any decisions regarding ASML or any other stock. Diversification and staying informed about industry trends are also crucial.

For the global economy, the health of the semiconductor industry is vital, and the trend in earnings estimate revisions for ASML could have broader implications. It’s essential for policymakers, industry experts, and investors to stay informed about industry trends and potential risks to mitigate any potential negative effects.

- ASML experienced significant stock movement in the last trading session, with higher-than-average trading volumes.

- The trend in earnings estimate revisions for ASML has been downward, which could potentially lead to a negative reaction from the market.

- Individual investors should consider their investment goals, risk tolerance, and investment horizon before making any decisions regarding ASML or any other stock.

- The health of the semiconductor industry is vital for the global economy, and potential risks should be closely monitored.