AMD: A Compelling Valuation and a Strong Buy Opportunity

Advanced Micro Devices (AMD) has been making waves in the technology sector, especially in the area of artificial intelligence (AI) inference solutions. With its latest offerings, AMD is presenting a compelling investment opportunity for long-term investors.

Compelling Valuation

Trading at its lowest earnings multiple in nearly a decade, AMD’s valuation is an attractive proposition. The current multiple stands at around 15x, which is significantly lower than the industry average and AMD’s historical averages. This discrepancy between AMD’s current valuation and its intrinsic worth could provide substantial upside potential for investors.

Cost-Efficient AI Inference Solutions

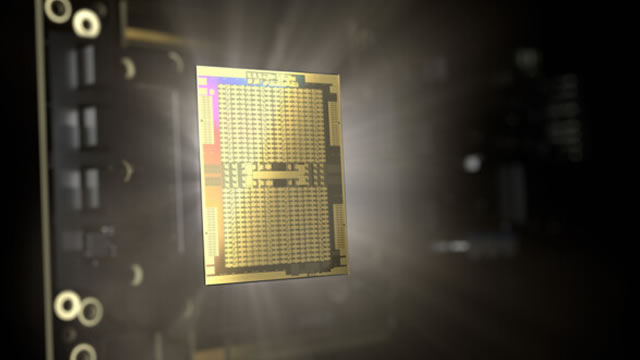

AMD’s potential lies in its ability to provide cost-efficient AI inference solutions. Inference is the process of applying learned models to new data to make predictions or decisions. This is a crucial step in AI applications, and it requires significant computational power. AMD’s new CPUs and GPUs, such as the Ryzen and Radeon series, offer impressive performance-per-dollar ratios, making them an attractive choice for businesses and individuals looking to implement AI solutions.

Gradually Winning Market Share from NVDA

Despite NVidia’s (NVDA) current dominance in the AI market, AMD is gradually winning market share. This is due to a combination of factors, including its cost-effective offerings, improving product line, and strategic partnerships. For instance, AMD’s collaboration with Microsoft on Azure AI and machine learning workloads is a significant step towards gaining a larger share of the AI market.

Risks

However, there are risks associated with investing in AMD. One of the most significant risks is NVDA’s continued market dominance. NVDA has a strong brand, established customer base, and a vast ecosystem of partners. It is also investing heavily in research and development (R&D) to maintain its competitive edge. Another risk is the higher R&D budgets of competitors like Intel (INTC). Intel is also making strides in the AI market, and its larger financial resources could allow it to challenge AMD’s position.

Macroeconomic Factors Affecting AI Capex Spend

Macroeconomic factors, such as global economic conditions and geopolitical tensions, could also impact AMD’s growth prospects. AI Capex spend is a significant component of AMD’s revenue, and any downturn in this area could negatively affect the company’s financial performance.

Effect on Individuals

For individuals, AMD’s strong position in the AI market could translate into better, more affordable AI solutions. This could lead to increased adoption of AI in various industries and applications, creating new opportunities for innovation and growth.

Effect on the World

On a larger scale, AMD’s progress in AI inference solutions could have a significant impact on the world. AI is becoming increasingly important in various sectors, from healthcare to finance, transportation to education. Affordable, efficient AI solutions could lead to breakthroughs in these areas, driving innovation and economic growth.

Conclusion

In conclusion, AMD’s compelling valuation, cost-efficient AI inference solutions, and strategic partnerships present a strong investment opportunity for long-term investors. However, there are risks associated with this investment, including NVDA’s market dominance, higher R&D budgets of competitors, and macroeconomic factors affecting AI Capex spend. Despite these risks, AMD’s potential to drive innovation and growth in the AI sector makes it an exciting investment prospect.

- AMD’s compelling valuation, with a current earnings multiple significantly lower than industry and historical averages

- AMD’s cost-efficient AI inference solutions, offering impressive performance-per-dollar ratios

- Gradual market share gains against NVDA, driven by strategic partnerships and improving product line

- Risks include NVDA’s market dominance, higher R&D budgets of competitors, and macroeconomic factors affecting AI Capex spend

- Individuals could benefit from better, more affordable AI solutions, leading to increased adoption and innovation

- AMD’s progress in AI inference solutions could have a significant impact on various industries and the world as a whole