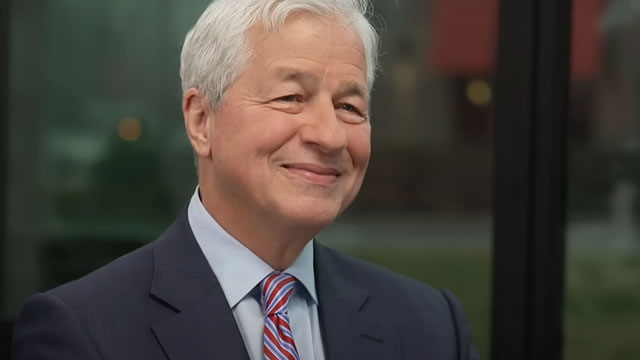

BlackRock CEO Larry Fink: Embracing Volatility as a Buying Opportunity

During a recent interview with Erik Schatzker at The Economic Club of New York, BlackRock CEO Larry Fink shared his perspective on the recent selloff in US equities. Amidst the market turbulence, Fink saw an opportunity that investors might want to consider:

Fink’s Take on the Current Market Conditions

Fink acknowledged the uncertainty in the market, admitting that it was hard to predict short-term movements. However, he emphasized the importance of maintaining a long-term perspective:

“The market is volatile, and it’s important for investors to remember that short-term movements don’t necessarily indicate long-term trends.”

Why Fink Sees the Selloff as a Buying Opportunity

Fink believes that the recent selloff in US equities was driven by a combination of factors, including geopolitical tensions and concerns over rising interest rates. He pointed out that these concerns were not new and that the market had faced similar challenges in the past:

“History has shown us that market volatility often creates buying opportunities. Companies with strong fundamentals and a solid growth outlook often see their stock prices decline during market downturns, making them attractive for long-term investors.”

How This Affects Individual Investors

For individual investors, Fink’s comments serve as a reminder that market volatility is a natural part of investing. It’s important for investors to have a well-diversified portfolio and to focus on the long-term:

- Diversify your portfolio: Spread your investments across various asset classes and sectors to reduce risk.

- Maintain a long-term perspective: Don’t let short-term market movements sway your investment decisions.

- Stick to your investment plan: Regularly review your portfolio and make adjustments as needed, but avoid making impulsive decisions based on market noise.

How This Affects the World

On a larger scale, Fink’s comments reflect the growing consensus among investors and economists that market volatility is here to stay. This could have implications for central banks, governments, and businesses:

- Central banks: Central banks may need to be more cautious in their monetary policy decisions, as market volatility could increase the risk of financial instability.

- Governments: Governments may need to focus on policies that promote economic stability and growth, as market volatility could undermine confidence and lead to economic uncertainty.

- Businesses: Businesses may need to be more flexible and adaptable in the face of market volatility, as they could be impacted by changes in consumer sentiment, supply chains, and financing costs.

Conclusion

In conclusion, BlackRock CEO Larry Fink’s comments on the recent selloff in US equities serve as a reminder that market volatility is a natural part of investing. While the short-term outlook may be uncertain, investors with a long-term perspective can use market downturns as opportunities to buy high-quality companies at attractive prices. For individual investors, this means maintaining a well-diversified portfolio and focusing on the long-term. On a larger scale, Fink’s comments have implications for central banks, governments, and businesses, who may need to adapt to the new reality of increased market volatility.

As always, it’s important for investors to stay informed and to seek professional advice when making investment decisions. And remember, while market volatility can be unsettling, it’s also a reminder that the markets are dynamic and full of opportunity.

Happy investing!