Toromont: A Powerhouse in Eastern Canada’s Heavy Equipment Industry

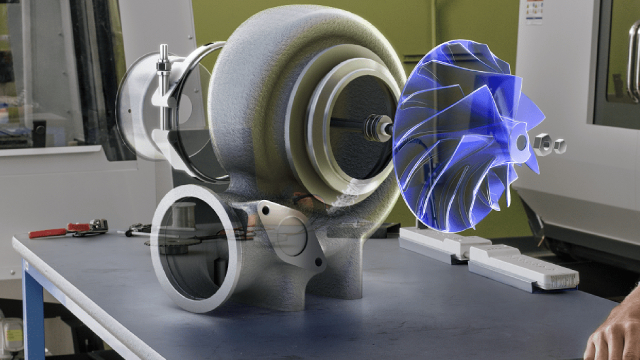

Toromont Industries Ltd. (Toromont), based in Canada, has carved out a unique position for itself as the exclusive Caterpillar dealer in Eastern Canada. This strategic alliance with Caterpillar, a global leader in heavy equipment manufacturing, has propelled Toromont to impressive earnings growth.

Strong Demand Drivers

Toromont’s earnings growth is underpinned by robust demand in key sectors such as public infrastructure and mining. Infrastructure projects, including transportation, water, and energy, are essential for any growing economy. Meanwhile, the mining sector, driven by increasing global demand for commodities like iron ore, copper, and gold, continues to be a significant revenue contributor for Toromont.

Consistent Dividends and Shareholder Value

Toromont’s commitment to shareholder value is evident in its impressive track record. The company has paid dividends for 36 consecutive years, a testament to its financial stability. With a low payout ratio, Toromont maintains a healthy balance between distributing profits to shareholders and reinvesting in its business. Additionally, Toromont boasts a robust share buyback program, further enhancing shareholder value.

Risk Mitigation

Toromont’s revenue diversification from parts and services, along with its geographic diversification, acts as a shield against cyclicality and trade uncertainties. The company’s parts and services revenue stream provides a steady cash flow, even during periods of lower equipment sales. Furthermore, having operations in multiple countries reduces Toromont’s reliance on any single market, thereby minimizing risks.

Impact on Individuals

As an individual investor, Toromont’s consistent earnings growth, strong financial position, and commitment to shareholder value make it an attractive investment opportunity. Its diversified revenue streams and geographic reach provide a level of stability and resilience that can help mitigate risks in your investment portfolio.

Impact on the World

On a global scale, Toromont’s success as a Caterpillar dealer in Eastern Canada contributes to the growth and development of the region. The infrastructure projects facilitated by Toromont help improve transportation networks, provide access to clean water, and ensure reliable energy supplies. Moreover, the mining sector, fueled by Toromont’s equipment sales and support, plays a crucial role in meeting the world’s growing demand for essential commodities.

Conclusion

Toromont Industries Ltd. stands out as a powerhouse in Eastern Canada’s heavy equipment industry, leveraging its strategic alliance with Caterpillar to drive earnings growth. Its commitment to shareholder value, strong financial position, and risk mitigation strategies make it an attractive investment opportunity for individuals. Furthermore, Toromont’s impact on the region and the world through its infrastructure and mining projects underscores its importance as a key player in the global heavy equipment market.

- Toromont’s strategic alliance with Caterpillar has driven impressive earnings growth.

- Robust demand in public infrastructure and mining sectors supports Toromont’s growth.

- Toromont’s 36-year track record of consistent dividends and share buyback program enhances shareholder value.

- Diversified revenue streams and geographic reach mitigate risks.

- Toromont’s success as a Caterpillar dealer contributes to regional growth and development.

- Toromont’s impact on the mining sector helps meet the world’s growing demand for essential commodities.