Advance Auto Parts (AAP) Earnings Report Analysis

Thirty days have passed since Advance Auto Parts (AAP) reported its third-quarter earnings. The stock market reaction was relatively positive, with a slight increase in share price following the news. But, the question on every investor’s mind is, “What’s next for AAP stock?” Let’s delve deeper into the financials and industry trends to gain some insights.

Financial Performance

In the third quarter, AAP reported earnings per share (EPS) of $2.48, beating analysts’ expectations of $2.36. Revenue came in at $2.5 billion, just shy of the projected $2.53 billion. The company’s gross profit margin expanded by 140 basis points, driven by higher sales and improved pricing strategies. Operating income increased by 10.3% year-over-year, demonstrating strong operational efficiency.

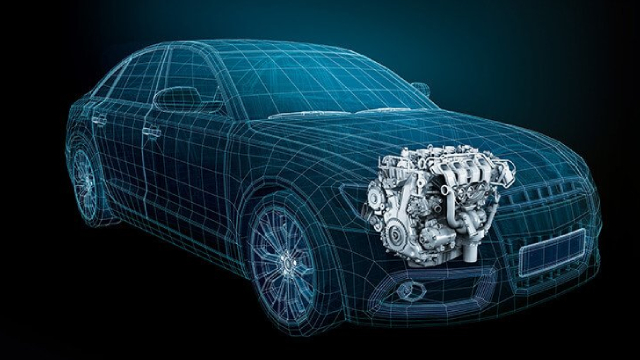

Industry Trends

The automotive aftermarket industry, in which AAP operates, has experienced steady growth in recent years. According to a report by Grand View Research, the global automotive aftermarket is projected to reach $1.2 trillion by 2027, growing at a CAGR of 4.2% from 2020 to 2027. Factors contributing to this growth include increasing vehicle parc, rising disposable income, and a growing trend towards DIY (Do-It-Yourself) car repairs.

Management Outlook

During the earnings call, AAP’s management provided an optimistic outlook for the future. They announced plans to expand their digital presence, focusing on e-commerce and mobile platforms. Additionally, they plan to invest in their store network, with a focus on improving the customer experience. These initiatives are expected to drive growth in the coming quarters.

Impact on Individual Investors

For individual investors, the positive earnings report and management outlook could be a bullish sign for AAP stock. However, it’s essential to consider the current market conditions and potential risks. The stock market has been volatile in recent months, with rising interest rates and geopolitical tensions creating uncertainty. As such, investors should consider diversifying their portfolios and consulting with financial advisors before making any significant investment decisions.

Impact on the World

On a larger scale, AAP’s strong financial performance and growth initiatives could have a positive impact on the global automotive aftermarket industry. By investing in digital platforms and improving the customer experience, AAP is positioning itself to capitalize on the growing trend towards DIY car repairs and the increasing vehicle parc. This could lead to increased competition and innovation within the industry, ultimately benefiting consumers and driving further growth.

Conclusion

In conclusion, Advance Auto Parts’ third-quarter earnings report showed strong financial performance and a positive outlook for the future. The company’s focus on digital initiatives and store network improvements is expected to drive growth in the coming quarters. For individual investors, the positive earnings report and management outlook could be a bullish sign for AAP stock, but it’s essential to consider current market conditions and potential risks before making any significant investment decisions. On a larger scale, AAP’s growth initiatives could have a positive impact on the global automotive aftermarket industry, driving competition and innovation.

- Advance Auto Parts reported strong third-quarter earnings, with EPS of $2.48 and revenue of $2.5 billion.

- The company’s gross profit margin expanded by 140 basis points, driven by higher sales and improved pricing strategies.

- Management announced plans to expand their digital presence and invest in their store network.

- The automotive aftermarket industry is projected to reach $1.2 trillion by 2027, driven by increasing vehicle parc and rising disposable income.

- Individual investors should consider diversifying their portfolios and consulting with financial advisors before making any significant investment decisions.

- AAP’s growth initiatives could have a positive impact on the global automotive aftermarket industry, driving competition and innovation.