Robinhood’s Expansion into Asset Management: A New Era for Investors

Robinhood Markets, the innovative fintech company behind the popular free trading app, has recently announced its plans to offer customers a new service: managed investment portfolios. This move represents a significant shift for the company, which has long been known for its commission-free trading platform that democratized access to the stock market for individual investors.

Robinhood’s New Offering: An Overview

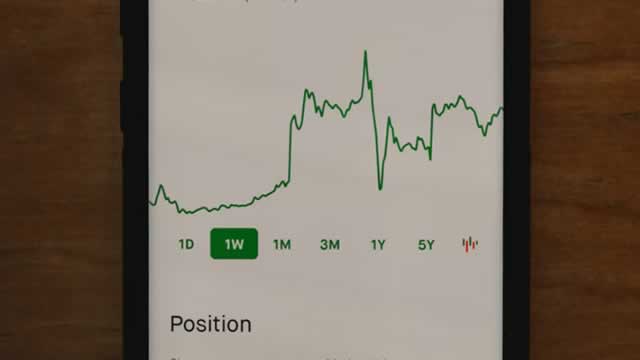

Under the new service, Robinhood will use computer algorithms to manage customers’ investments, offering a mix of exchange-traded funds (ETFs) based on their risk tolerance and investment goals. The service, named “Robinhood Gold” and “Robinhood Invest,” will be available to customers who pay a monthly subscription fee of $5 or $10, respectively. The company plans to roll out the new service gradually, starting with a limited number of users.

The Impact on Individual Investors

For individual investors, Robinhood’s expansion into asset management presents both opportunities and challenges. On the one hand, the new service offers a convenient and cost-effective way to manage their investments. With a low-cost subscription fee, investors can benefit from professional portfolio management without the high fees typically associated with traditional wealth management firms. Moreover, Robinhood’s user-friendly platform and mobile app make it easy for users to monitor their investments and adjust their portfolios on the go.

The Impact on the World

From a broader perspective, Robinhood’s entry into asset management could have significant implications for the financial industry. The company’s move represents a growing trend of fintech firms offering robo-advisory services, which use algorithms to manage customer investments. This trend is expected to disrupt the traditional wealth management industry, as more and more investors turn to low-cost, digital alternatives.

Conclusion

Robinhood’s expansion into asset management marks an exciting new chapter for the company and the investing public. By offering managed investment portfolios, Robinhood is positioning itself as a one-stop-shop for individual investors, providing them with a convenient, cost-effective, and accessible way to manage their investments. As the fintech industry continues to evolve, it will be interesting to see how traditional wealth management firms respond to this trend and how it shapes the future of investing.

- Robinhood offers managed investment portfolios using computer algorithms

- New service available to customers who pay a monthly subscription fee

- Opportunities and challenges for individual investors

- Disruptive trend in the financial industry