Discovering Hidden Gems: Nordstrom (JWN) – A Momentum Stock at Bargain Prices

In the ever-changing world of stocks, identifying companies that have gained strong momentum recently but are still trading at reasonable prices can be a goldmine for investors. One such stock that has piqued our interest is Nordstrom, Inc. (JWN).

About Nordstrom

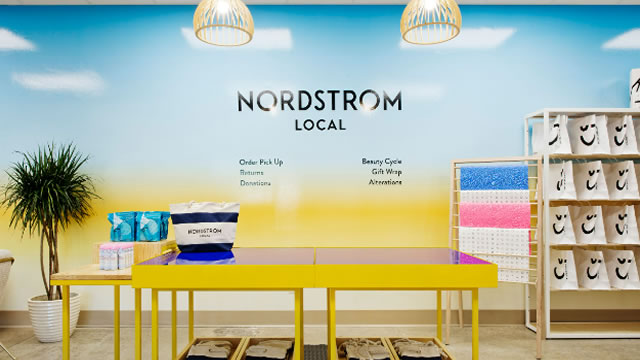

Founded in 1901, Nordstrom is a leading fashion retailer based in the United States. The company offers a wide range of merchandise through various channels, including its website, Nordstrom.com, Nordstrom Rack, and its 359 full-line stores. Nordstrom’s product offerings span across various categories, including women’s, men’s, kids, home, and beauty.

Why Nordstrom is a Momentum Stock at a Bargain Price

Despite the challenges posed by the global pandemic, Nordstrom has managed to maintain its momentum. In its most recent quarterly report, the company reported earnings per share (EPS) of $1.16, which surpassed analysts’ estimates by $0.44. Furthermore, Nordstrom’s revenue grew by 27.5% year-over-year, driven primarily by its online sales.

Nordstrom’s Growth Strategy

Nordstrom’s growth strategy focuses on three key areas: expanding its digital presence, enhancing its retail stores, and optimizing its supply chain. The company has made significant investments in its digital capabilities, including its website and mobile app, to meet the increasing demand for online shopping. Additionally, Nordstrom has been renovating its retail stores to create more engaging shopping experiences for customers.

Impact on Me: A Potential Investment Opportunity

As an investor, the potential impact of Nordstrom’s strong momentum and reasonable valuation could translate into capital appreciation and dividend income. According to some financial analysts, JWN’s stock is undervalued and could offer a significant return on investment. However, as with any investment, it’s essential to conduct thorough research and consider the risks involved.

Impact on the World: Fueling the Retail Sector’s Recovery

Nordstrom’s strong financial performance is a positive sign for the retail sector, which has been severely impacted by the pandemic. The company’s success could encourage other retailers to adopt similar growth strategies, leading to a broader recovery of the sector. Additionally, Nordstrom’s focus on digital capabilities could set a trend for other retailers to follow, further fueling the growth of the e-commerce sector.

Conclusion: A Momentum Stock Worth Considering

In conclusion, Nordstrom’s strong momentum and reasonable valuation make it an attractive investment opportunity for those looking to capitalize on recent market trends. The company’s focus on expanding its digital presence, enhancing its retail stores, and optimizing its supply chain positions it well for continued growth. Furthermore, Nordstrom’s success could have a positive impact on the retail sector’s recovery and the broader e-commerce industry.

- Nordstrom (JWN) is a leading fashion retailer with a strong momentum

- The company reported earnings and revenue that surpassed analysts’ estimates

- Nordstrom’s growth strategy focuses on expanding digital presence, enhancing retail stores, and optimizing supply chain

- As an investor, Nordstrom’s strong financial performance could translate into capital appreciation and dividend income

- Nordstrom’s success could have a positive impact on the retail sector’s recovery and the broader e-commerce industry