Micron Technology’s Q3 Earnings: A Mixed Bag of Sales Growth and Margin Pressure

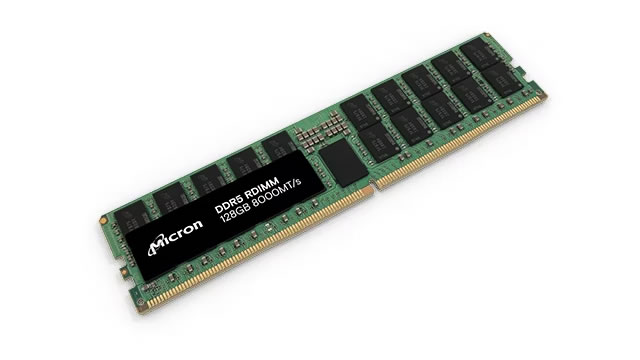

Micron Technology, Inc., a leading global manufacturer and provider of semiconductor solutions, recently reported its third-quarter financial results, showcasing a 38.3% year-over-year (YoY) revenue increase. This growth was primarily driven by the robust sales of DRAM and NAND, which accounted for 83% and 17% of the total revenue, respectively.

DRAM and NAND Sales: The Driving Force

The DRAM segment’s revenue grew by 42.5% YoY, reaching $6.2 billion. This surge was attributed to the strong demand for DRAM in the data center, graphics, and mobile markets. The NAND segment, on the other hand, reported a 28.8% YoY revenue growth, generating $3.4 billion in revenue, driven by the expanding demand for solid-state drives (SSDs) and other NAND-based products.

Competitive Landscape and Margin Pressure

Despite the impressive sales growth, Micron faced margin pressures and competitive pricing, particularly from Chinese manufacturers. The intense competition in the memory market led to a decline in the company’s gross margin, which fell from 40.8% in the previous quarter to 38.4% in Q3. This margin compression was a significant concern for investors, leading to a decrease in Micron’s stock price.

Q3 Guidance: Sales Up, Margin Pressure Remains

Micron’s Q3 guidance indicated a 20% YoY increase in sales, reaching $7.4 billion. However, the company expects its gross margin to remain under pressure, hovering around 38%. To mitigate the margin pressures, Micron plans to carefully manage its capacity and invest in high-bandwidth memory (HBM) chips, which are expected to deliver higher profitability.

Impact on Consumers and the World

For consumers, this news might not have a significant direct impact, as the sales growth primarily benefits the technology industry. However, the ongoing competition and margin pressures could lead to price fluctuations in memory products, such as RAM and SSDs. This, in turn, could impact the cost of building or upgrading a computer system or purchasing a new device.

On a larger scale, Micron’s financial performance and the broader memory market dynamics highlight the importance of technology innovation and strategic investments in the semiconductor industry. As the demand for data-intensive applications and advanced technologies continues to grow, companies like Micron must invest in research and development to stay competitive and maintain profitability. Moreover, the ongoing competition and margin pressures underscore the need for a balanced and dynamic market, where various players can thrive and contribute to the industry’s growth.

Conclusion

Micron Technology’s Q3 earnings report revealed a 38.3% YoY revenue increase, driven by strong sales in DRAM and NAND. However, the company faced margin pressures and competitive pricing, leading to a decline in its stock price. Micron’s Q3 guidance indicates continued sales growth but ongoing margin pressure, necessitating careful management of capacity and investments in HBM chips. The impact on consumers is expected to be minimal, but price fluctuations in memory products could occur. The broader implications of Micron’s performance and the memory market dynamics underscore the importance of innovation, strategic investments, and a balanced market for the semiconductor industry’s growth.