Goldman Sachs Reaffirms Buy Rating for Comcast Corporation

In a recent research note, Goldman Sachs analyst Michael Ng maintained his positive outlook on Comcast Corporation (CMCSA), reiterating his Buy rating and increasing the price target to $44 from the previous $42. The analyst believes that Comcast’s strong position in the media and communications industry, combined with its strategic acquisitions and growth initiatives, will drive the company’s stock higher.

Reason for the Bullish Outlook

According to Ng, Comcast’s robust cash flow generation, which is expected to grow at a steady pace, is a major reason for his bullish stance on the stock. He also highlighted the company’s strong balance sheet, which provides it with ample financial flexibility to pursue growth opportunities.

Strategic Acquisitions and Growth Initiatives

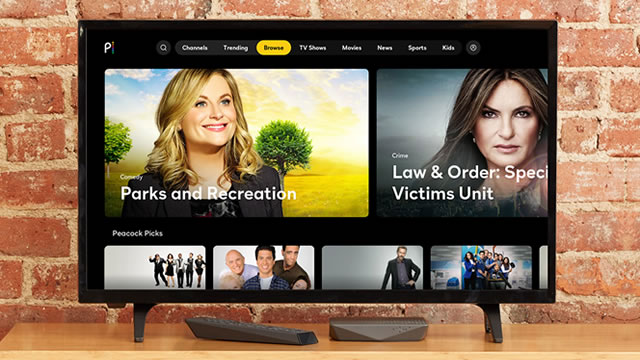

Comcast’s strategic acquisitions, such as its purchase of NBCUniversal and DreamWorks Animation, have expanded its media and entertainment portfolio and positioned it as a key player in the content creation and distribution business. The company’s growth initiatives, including the expansion of its high-speed internet and business services, as well as its investment in new technologies like 5G and artificial intelligence, are also expected to contribute to its revenue growth.

Impact on Individual Investors

For individual investors, Goldman Sachs’ bullish outlook on Comcast could mean potential gains if they decide to buy the stock. The analyst’s price target of $44 implies an upside of approximately 14% from the current price, making it an attractive investment opportunity for those looking for growth in the media and communications sector.

Impact on the World

At a larger scale, Goldman Sachs’ reiteration of its Buy rating on Comcast could have a ripple effect on the broader market. The analyst’s positive stance on the stock could lead to increased demand for the shares, driving up the price and potentially boosting the overall performance of the media and communications sector. Furthermore, Comcast’s continued growth and success could set a positive trend for other companies in the industry, encouraging investment and innovation.

Conclusion

In summary, Goldman Sachs’ reiteration of its Buy rating on Comcast Corporation, along with the increase in its price target, reflects the analyst’s confidence in the company’s ability to generate strong cash flow, execute strategic acquisitions, and grow through innovative initiatives. For individual investors, this could mean potential gains from the stock, while for the world, it could lead to increased demand for media and communications stocks and a positive trend for the industry as a whole.

- Goldman Sachs maintains Buy rating on Comcast Corporation (CMCSA)

- Price target increased to $44 from $42

- Strong cash flow generation

- Expansive media and entertainment portfolio

- Growth initiatives in high-speed internet and new technologies

- Positive impact on individual investors and the broader market