KMT’s Operating Segments: Challenges and Concerns

KMT Corporation, a leading multinational conglomerate, has recently reported a weak performance in its operating segments. This trend, which has been ongoing for some time, has raised concerns among investors and industry analysts. In this blog post, we’ll take a closer look at the factors contributing to this weakness and the potential implications.

Operating Segments: A Closer Look

KMT’s business is divided into three main operating segments: Technology, Manufacturing, and Services. Each segment has faced unique challenges in recent quarters.

Technology Segment: Slowing Growth

The Technology segment, which includes software development, IT services, and digital media, has seen slower growth due to increased competition and changing market dynamics. KMT’s inability to innovate and adapt to new technologies has resulted in lost market share and revenue.

Manufacturing Segment: Operational Inefficiencies

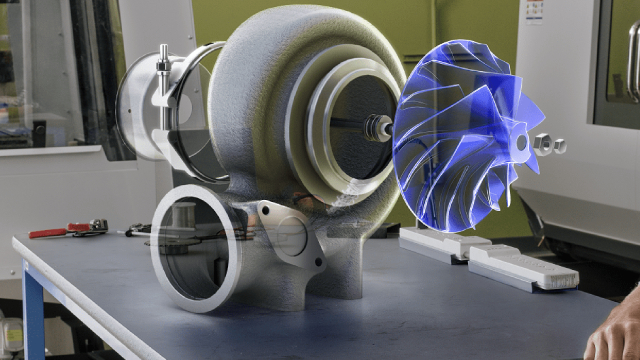

The Manufacturing segment, which accounts for a significant portion of KMT’s revenue, has been plagued by operational inefficiencies. These inefficiencies, which include high production costs and low productivity, have negatively impacted profitability.

Services Segment: Intense Competition

The Services segment, which includes consulting, engineering, and construction services, has faced intense competition from local and global players. KMT’s inability to differentiate itself from competitors and offer competitive pricing has resulted in lost contracts and revenue.

Operating Expenses: A Growing Concern

In addition to these challenges, KMT has also seen an increase in operating expenses. This increase, which is due to higher salaries, benefits, and overhead costs, has put further pressure on profitability.

Implications for Individuals

For individuals, the weak performance and growing concerns surrounding KMT could lead to job losses in the affected segments. Additionally, investors in KMT stock may experience losses if the company fails to turn around its performance.

Implications for the World

At a larger scale, the challenges facing KMT could have implications for the global economy. As a leading multinational conglomerate, KMT’s performance is closely watched by investors and financial markets. A continued decline in KMT’s performance could lead to decreased investor confidence and negatively impact global economic growth.

Conclusion

In conclusion, KMT’s weak performance in its operating segments and increasing operating expenses are cause for concern. These challenges, which are affecting the Technology, Manufacturing, and Services segments, could lead to job losses and decreased investor confidence. At a larger scale, the implications for the global economy could be significant. It remains to be seen whether KMT will be able to turn around its performance and address these challenges effectively.

- Operating segments: Technology, Manufacturing, and Services

- Challenges: Slowing growth, operational inefficiencies, and intense competition

- Operating expenses: Increasing salaries, benefits, and overhead costs

- Implications for individuals: Potential job losses and investment losses

- Implications for the world: Decreased investor confidence and potential negative impact on global economic growth