MU Stock: A Risky Bet Amidst Declining Profitability, Pricing Pressures, and Bearish Technical Indicators

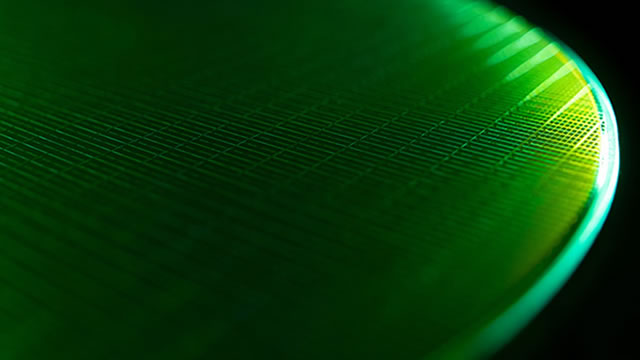

Microchip Technology Incorporated (MU) is a leading semiconductor company that has been making waves in the tech industry for years. However, recent trends in the stock market suggest that investing in MU might not be the best decision at the current moment. Here’s a closer look at the factors contributing to this risk:

Declining Profitability

MU’s profitability has been on a downward trend in recent quarters. In the third quarter of fiscal 2022, the company reported a 31% year-over-year decline in net income, amounting to $573.5 million. This decline was primarily due to increased operating expenses and lower revenue growth.

Pricing Pressures

Another concern for investors is the intense pricing pressure in the semiconductor industry. As competition heats up, companies are forced to lower their prices to stay competitive. MU has not been immune to this trend, and the company’s gross margins have been declining over the past few quarters.

Bearish Technical Indicators

From a technical perspective, MU stock is showing bearish signs. The stock has been trading below its 50-day moving average for several weeks, indicating a bearish trend. Additionally, the Relative Strength Index (RSI) is below 50, suggesting that the stock is oversold and due for a potential correction. However, a continued decline in the stock price could indicate a longer-term bearish trend.

Impact on Individual Investors

For individual investors, the declining profitability, pricing pressures, and bearish technical indicators suggest that MU stock may not be a wise investment at the current moment. The potential for continued price declines and weakened financial performance could result in significant losses for investors. It is essential to carefully consider the risks before making any investment decisions.

Impact on the World

On a larger scale, the decline in MU’s profitability and stock performance could have ripple effects on the semiconductor industry and the global economy. As a leading player in the industry, MU’s financial performance is closely watched by investors and analysts. A continued decline in the company’s stock price could lead to decreased confidence in the industry as a whole, potentially dampening investment and growth.

Conclusion

In conclusion, the sequential decline in profitability, intense pricing pressures, and bearish technical indicators make MU stock a risky bet at current levels. Individual investors should carefully consider the potential risks before making any investment decisions. Additionally, a continued decline in MU’s financial performance could have broader implications for the semiconductor industry and the global economy.

- MU’s profitability has been declining in recent quarters

- Pricing pressures in the semiconductor industry are intensifying

- Bearish technical indicators suggest a potential correction or longer-term bearish trend

- Individual investors should carefully consider the risks before investing in MU stock

- A continued decline in MU’s financial performance could have broader implications for the semiconductor industry and the global economy