Exploring the Investor Interest in Coinbase Global (COIN)

In the dynamic world of technology and finance, it’s essential to keep a close eye on trends that pique the interest of investors. One such trend that has recently gained significant traction among Zacks.com users is Coinbase Global, Inc. (COIN), an American company that operates a cryptocurrency exchange of the same name.

Background on Coinbase

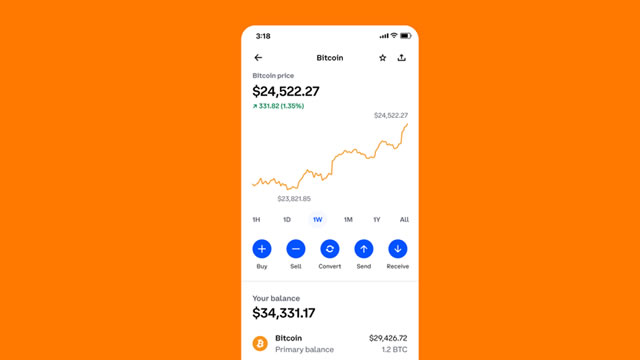

Founded in 2012, Coinbase offers a variety of digital asset services, including retail trading, institutional trading, custody, and prime brokerage. The company’s primary objective is to make it easier for individuals and institutions to buy, sell, and manage their cryptocurrencies. Coinbase’s user-friendly platform and robust security measures have contributed to its rapid growth and popularity.

Financial Performance of Coinbase

Coinbase went public on April 14, 2021, through a direct listing on the Nasdaq Stock Market. The company’s initial public offering (IPO) price was set at $250 per share, and it quickly surged to an intraday high of $429.54. Since then, COIN’s stock price has experienced volatility, but it has generally remained above its IPO price.

In its Q2 2021 earnings report, Coinbase reported revenue of $1.21 billion, a significant increase from the $152 million reported in the same quarter the previous year. The company’s net income was $1.6 billion, compared to a net loss of $322 million in Q2 2020. These impressive figures demonstrate the strong demand for cryptocurrency services and Coinbase’s ability to capitalize on this trend.

Impact on Individual Investors

For individual investors, the growing interest in Coinbase presents both opportunities and risks. On the one hand, owning COIN stock could potentially provide exposure to the broader cryptocurrency market. On the other hand, investing in a single company in a volatile sector carries inherent risks. It’s crucial for investors to thoroughly research the company, understand its business model, and assess its financial health before making a decision.

Impact on the World

The rise of Coinbase and other cryptocurrency companies is indicative of a broader trend: the increasing mainstream acceptance and adoption of digital currencies. As more individuals and institutions enter the cryptocurrency market, we can expect to see continued innovation, growth, and regulation in this space. While the impact on the world will vary depending on the specific use cases and applications of cryptocurrencies, it’s clear that this technology has the potential to disrupt traditional financial systems and create new opportunities.

Conclusion

In conclusion, the growing interest in Coinbase among Zacks.com users serves as a reminder of the dynamic and evolving nature of the technology and finance sectors. As a publicly-traded company, Coinbase offers investors an opportunity to gain exposure to the cryptocurrency market, but it’s essential to carefully consider the risks and potential rewards before making an investment decision. At a broader level, the rise of Coinbase and other cryptocurrency companies highlights the transformative potential of digital currencies and their ability to disrupt traditional financial systems.

- Coinbase is a popular cryptocurrency exchange that offers various digital asset services.

- The company went public in April 2021 and reported impressive financial results in Q2 2021.

- Individual investors should carefully consider the risks and potential rewards of investing in COIN.

- The rise of Coinbase and other cryptocurrency companies is indicative of the broader trend of mainstream cryptocurrency adoption.