American Tower Corporation’s Impressive Year-to-Date Performance:

American Tower Corporation (AMT), a leading independent owner, operator, and developer of communications real estate, has showcased impressive growth in the year 2023. The stock has rallied an impressive 17.8%, closing at $216.23 on the New York Stock Exchange (NYSE) on Friday. This significant increase places AMT ahead of its competitors and industry benchmarks.

Outperforming the Industry and the S&P 500:

American Tower’s stock performance surpasses not only its close industry peer, SBA Communications Corporation (SBAC), but also the Zacks REIT and Equity Trust – Other industry and the broader S&P 500 composite index. The S&P 500 has experienced a relatively modest growth of 11.5% year-to-date, while the Zacks REIT and Equity Trust – Other industry has seen a growth of 13.6%.

Factors Contributing to American Tower’s Success:

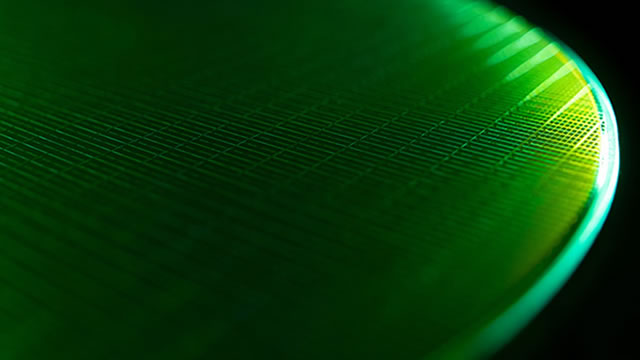

Several factors have contributed to American Tower’s strong performance. First, the increasing demand for wireless connectivity and the rollout of 5G networks have boosted the demand for communications real estate. American Tower is well-positioned to capitalize on this trend, as it owns and operates over 170,000 communications sites, including rooftops, towers, and other structures, across more than 20 countries.

Continued Growth Prospects:

Moreover, American Tower’s strategic initiatives, such as its focus on site leasing and its partnership with carriers to build and operate wireless networks, have also contributed to its growth. The company’s strong financial position, with a debt-to-equity ratio of 2.4 and a net debt of $21.2 billion, further cements its position as a stable investment.

Impact on Individual Investors:

For individual investors, American Tower’s strong performance offers an attractive opportunity to capitalize on the growth of the communications real estate sector. The company’s diverse portfolio of assets and its strategic initiatives position it well for continued growth in the future. However, it is important to note that investing in individual stocks carries risk, and investors should carefully consider their investment objectives, risk tolerance, and financial situation before making any investment decisions.

Global Implications:

At a global level, American Tower’s success is a testament to the growing importance of wireless connectivity and the role of communications real estate in supporting the digital economy. The company’s strong performance also highlights the potential for growth in emerging markets, where demand for wireless connectivity is increasing rapidly. As more countries invest in wireless infrastructure, companies like American Tower are likely to benefit from this trend.

Conclusion:

In conclusion, American Tower Corporation’s impressive year-to-date performance underscores the growing demand for wireless connectivity and the potential of the communications real estate sector. The company’s strategic initiatives, strong financial position, and diverse portfolio of assets position it well for continued growth in the future. For individual investors, American Tower offers an attractive opportunity to capitalize on this trend, while for the global economy, the company’s success highlights the importance of investing in wireless infrastructure to support the digital economy.

- American Tower Corporation (AMT) has rallied 17.8% year-to-date, outperforming the Zacks REIT and Equity Trust – Other industry and the S&P 500 composite index.

- Factors contributing to American Tower’s success include the increasing demand for wireless connectivity and the rollout of 5G networks, as well as the company’s strategic initiatives and strong financial position.

- Individual investors may find American Tower an attractive opportunity to capitalize on the growth of the communications real estate sector, but it is important to carefully consider investment objectives, risk tolerance, and financial situation before making any investment decisions.

- American Tower’s success also highlights the importance of investing in wireless infrastructure to support the global digital economy.