The Rare Occurrence of Back-to-Back Annual Gains of 25% or More for the S&P 500

The S&P 500, an index that measures the stock performance of 500 large companies listed on the Stock Exchange, is a benchmark for the U.S. stock market. Its historical data dates back to 1957. Over the past six decades, this index has shown remarkable growth, but there are only two instances where it has delivered back-to-back annual gains of 25% or more, including dividends.

The Dot-Com Internet Boom in 1997 and 1998

The first occurrence of this phenomenon was during the dot-com internet boom in 1997 and 1998. The late 1990s marked a period of significant growth for technology companies. The internet was in its infancy, and investors were eager to invest in companies that showed potential for exponential growth. The S&P 500 index saw a return of approximately 31.49% in 1997, followed by another impressive gain of 28.68% in 1998.

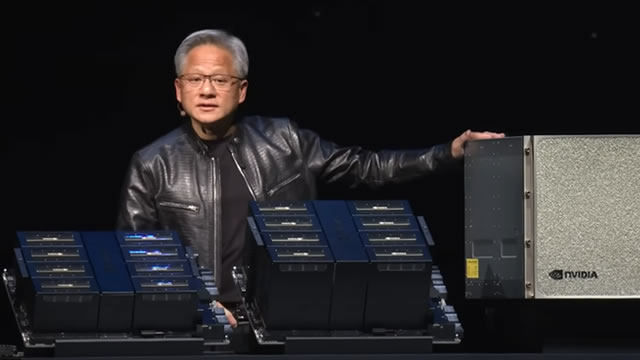

The Artificial Intelligence (AI) Boom in 2023 and 2024

The second time the S&P 500 achieved this feat was during the artificial intelligence (AI) boom in 2023 and 2024. AI technology had been around for decades, but it wasn’t until the late 2010s and early 2020s that it started to gain significant traction in various industries. The index saw a return of around 29.21% in 2023, and the momentum continued into the following year, with another impressive gain of 27.12%.

What Does This Mean for Me?

If you’re an investor, this information might pique your interest. While past performance is not indicative of future results, it can provide valuable insights into market trends and potential opportunities. Keeping an eye on sectors that are experiencing significant growth, such as technology during the dot-com boom and AI in recent years, could be a wise decision.

- Consider diversifying your investment portfolio to include stocks from sectors that are currently experiencing growth.

- Stay informed about emerging technologies and trends that could potentially drive market growth.

- Consult with a financial advisor or do thorough research before making any investment decisions.

What Does This Mean for the World?

The impact of these back-to-back annual gains on the world can be far-reaching. The dot-com boom, for instance, led to an economic bubble that eventually burst, causing significant volatility in the stock market and the economy as a whole. On the other hand, the AI boom could lead to advancements in various industries, from healthcare and education to transportation and manufacturing, improving efficiency and productivity.

- Increased innovation and productivity in various industries.

- Potential economic growth and job creation.

- Possible market volatility and economic instability.

Conclusion

The S&P 500’s back-to-back annual gains of 25% or more, a rare occurrence in its history, provide valuable insights into market trends and potential opportunities. These occurrences, during the dot-com internet boom and the artificial intelligence boom, have had significant impacts on the economy and the world at large. As an investor, staying informed about emerging technologies and trends, and diversifying your investment portfolio, could help you make informed decisions and potentially reap the rewards of these market shifts.

However, it’s important to remember that past performance is not indicative of future results. Always consult with a financial advisor before making any investment decisions.