Micron’s Strong Performance: A Game Changer for Tech Industry and Individual Investors

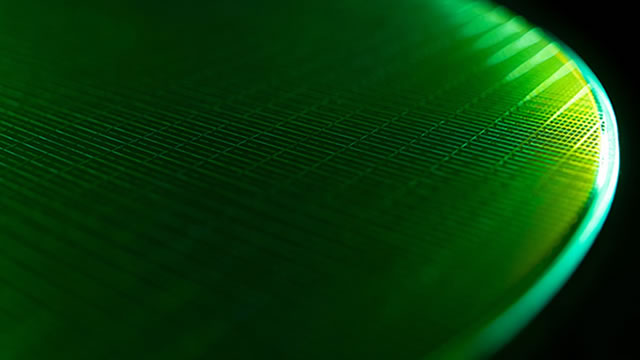

Micron Technology, Inc., a leading global semiconductor company, recently reported impressive financial results for its second quarter of fiscal year 2025 (FY25). The company’s strong performance is a testament to its robust HBM (High Bandwidth Memory) growth and strategic capacity expansion.

Micron’s Impressive Financial Results

Micron reported a 38.3% increase in revenue to $8.3 billion, surpassing analysts’ expectations. The company’s adjusted operating income grew by 24.9% to $3.1 billion. These figures demonstrate Micron’s ability to capitalize on the growing demand for memory products, particularly HBM.

Record-Breaking HBM Revenue Growth

Micron’s HBM revenue grew an astounding 50% sequentially, reaching a record high. This growth can be attributed to the increasing adoption of HBM in data centers, artificial intelligence (AI), and machine learning applications. With the rise of big data and advanced computing technologies, the demand for high-performance memory solutions is expected to continue.

Future Growth Projections

Micron is guiding for $8.8 billion in revenue for the third quarter of FY25. The company is forecasting a 38.2% year-over-year growth for FY25. These projections are a result of Micron’s strategic investments in HBM manufacturing, which will enable the company to meet the growing demand for its products.

Impact on Individual Investors

For individual investors, Micron’s strong financial results and growth projections translate to potential capital gains. Based on current market conditions, a ‘Strong Buy’ rating on Micron stock with a fair value of $140 per share is a sound investment decision.

Impact on the Tech Industry

Micron’s impressive financial performance and growth projections will have a significant impact on the tech industry as a whole. The company’s ability to meet the growing demand for high-performance memory solutions will enable advancements in AI, machine learning, and data center technologies. This, in turn, will drive innovation and growth in various industries, from healthcare and finance to transportation and entertainment.

Conclusion

Micron’s strong financial results and growth projections are a clear indication of the company’s ability to capitalize on the growing demand for high-performance memory solutions. This not only bodes well for individual investors but also for the tech industry as a whole. As the world continues to generate and process increasingly large amounts of data, the need for advanced memory technologies will only grow. Micron’s strategic investments in HBM manufacturing position the company to meet this demand and drive innovation in various industries. It’s an exciting time to be a part of the tech industry, and Micron is leading the charge.

- Micron reported 38.3% revenue growth and 24.9% adjusted operating income in Q2 FY25

- HBM revenue grew 50% sequentially, reaching a record high

- Micron is guiding for $8.8 billion in Q3 FY25 revenue and 38.2% year-over-year growth for FY25

- Individual investors can consider a ‘Strong Buy’ rating on Micron stock with a fair value of $140 per share

- Micron’s strong performance will drive innovation and growth in the tech industry