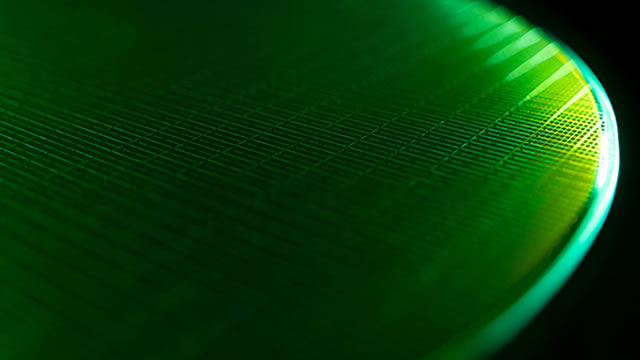

Micron’s Robust Performance and Future Outlook: A Strong Buy Case

Micron Technology, Inc. (Micron), a leading global manufacturer and provider of semiconductor solutions, continues to impress investors with its robust financial performance and strategic expansion. In its latest earnings report for the second quarter of fiscal 2025 (Q2 FY25), Micron reported a 38.3% increase in revenue to $10.5 billion, exceeding analysts’ expectations. The company also recorded a 24.9% adjusted operating income, demonstrating its operational efficiency.

Record-Breaking HBM Growth

One of the key drivers of Micron’s impressive growth was its High Bandwidth Memory (HBM) business. HBM revenue grew by an astounding 50% sequentially, reaching a record high of $2.5 billion. This growth can be attributed to Micron’s strategic focus on HBM and its increasing adoption in various markets, including artificial intelligence (AI), machine learning (ML), graphics, and automotive.

Strategic Capacity Expansion

Micron’s growth story doesn’t end there. The company is investing heavily in expanding its HBM manufacturing capacity to meet the growing demand. Micron is guiding for $8.8 billion in revenue for Q3 FY25, representing a significant 38.2% year-over-year growth. These investments will not only help Micron meet the current demand but also position the company for future growth opportunities.

Impact on Individuals: Opportunities and Risks

For individual investors, Micron’s strong financial performance and growth prospects make it an attractive investment opportunity. With a ‘Strong Buy’ rating and a fair value of $140 per share, Micron presents an opportunity to capitalize on the growing demand for HBM and its strategic expansion. However, as with any investment, there are risks involved, including market volatility, regulatory risks, and competition.

Impact on the World: A Catalyst for Innovation

Beyond the financial implications, Micron’s growth story has wider implications for the world. The increasing adoption of HBM in various industries, such as AI, ML, and automotive, is driving innovation and pushing the boundaries of what’s possible. Micron’s strategic investments in HBM manufacturing will further fuel this innovation, enabling breakthroughs in fields such as autonomous vehicles, advanced robotics, and real-time data processing.

Conclusion: A Bright Future Ahead

In conclusion, Micron’s robust financial performance and strategic expansion in the HBM market position the company for a bright future. With record-breaking growth, significant investments in manufacturing capacity, and the increasing adoption of HBM in various industries, Micron is well-positioned to capitalize on this trend and drive innovation. For individual investors, this presents an attractive investment opportunity, while for the world, it’s a catalyst for innovation and progress.

- Micron reported a 38.3% increase in revenue to $10.5 billion in Q2 FY25

- Adjusted operating income was 24.9%

- HBM revenue grew by 50% sequentially to $2.5 billion

- Micron is guiding for $8.8 billion in revenue for Q3 FY25

- Significant investments in HBM manufacturing capacity

- HBM adoption driving innovation in various industries

- Micron’s growth story presents an attractive investment opportunity