North American Construction’s Q3 Earnings Miss Estimates: A Closer Look

North American Construction (NOA) recently reported its Q3 earnings, coming in at $0.71 per share, falling short of the Zacks Consensus Estimate of $0.73 per share. This figure represents a 13.2% increase compared to the same quarter last year when the company reported earnings of $0.64 per share.

Impact on Investors

The earnings miss may negatively impact NOA’s stock price as investors may react to the news by selling their shares. This could potentially lead to a decrease in the stock price, as market forces adjust to the new information. Furthermore, the earnings miss may raise concerns about the company’s future earnings growth potential, potentially leading to a decrease in the company’s valuation.

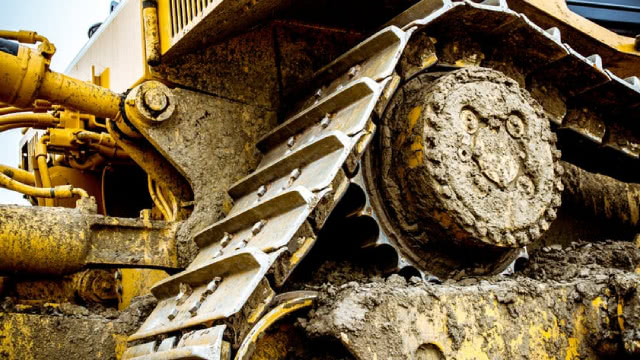

Impact on the Construction Industry

The construction industry as a whole may not be significantly impacted by NOA’s earnings miss, as it is just one player in a large and diverse industry. However, if NOA’s earnings miss is indicative of broader industry trends, such as decreased demand for construction services or increased costs, then the industry may face challenges. This could lead to decreased profits for construction companies, potentially resulting in reduced hiring and investment in new projects.

Factors Contributing to the Earnings Miss

Several factors may have contributed to NOA’s earnings miss. These include increased competition, higher input costs, and decreased demand for construction services in certain markets. The company may also have experienced operational inefficiencies or delays in project completions, leading to lower revenues and profits.

Future Outlook

Despite the earnings miss, NOA remains optimistic about its future prospects. The company has a strong backlog of projects and a diverse range of services, which should help mitigate the impact of any potential industry headwinds. Additionally, the company is focused on cost control measures and operational improvements, which should help improve profitability in the future.

Conclusion

North American Construction’s Q3 earnings miss may negatively impact the company’s stock price and raise concerns about the construction industry as a whole. However, the company remains optimistic about its future prospects and is taking steps to improve profitability. As always, investors are encouraged to closely monitor the company’s earnings reports and industry trends to stay informed about the company’s performance and future outlook.

- NOA reported Q3 earnings of $0.71 per share, missing the Zacks Consensus Estimate of $0.73 per share.

- This represents a 13.2% increase compared to the same quarter last year.

- The earnings miss may negatively impact NOA’s stock price and raise concerns about the construction industry.

- Factors contributing to the earnings miss include increased competition, higher input costs, and decreased demand for construction services in certain markets.

- The company remains optimistic about its future prospects and is taking steps to improve profitability.