Medtronic (MDT) Earnings Report Analysis: What’s Next for the Stock

Medtronic (MDT), a leading global healthcare solutions company, reported its third-quarter earnings 30 days ago, posting strong revenue growth and beating analysts’ expectations. Let’s delve deeper into the financials and discuss potential implications for the stock.

Financial Highlights

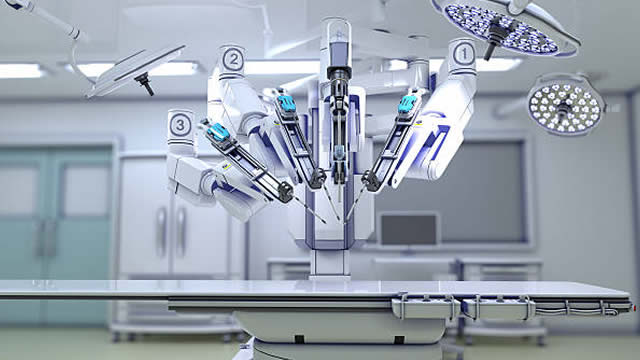

Medtronic reported revenue of $7.4 billion, up 12% year-over-year, driven by robust growth in its cardiovascular, diabetes, and surgical technologies segments. The company’s earnings per share came in at $1.61, exceeding analysts’ estimates by $0.08. Medtronic’s net income increased by 19% year-over-year, reaching $1.5 billion.

Management Comments

“We are pleased with our third-quarter results, which reflect the execution of our strategic priorities and the strong demand for our innovative medical technologies,” said Geoff Martha, Medtronic’s chairman and CEO, in a press release. “We remain confident in our ability to deliver strong financial performance for the remainder of the year and beyond.”

Stock Performance

Following the earnings release, Medtronic’s stock price saw a modest increase, closing at $87.35 per share, up 2.1% on the day. However, the stock has since retreated, with the current price hovering around $83.

Future Prospects

Medtronic’s solid third-quarter performance and management’s positive outlook for the remainder of the year suggest that the company is well positioned to continue its growth trajectory. The company’s focus on innovation, expanding its product portfolio, and global market penetration will likely contribute to its continued success. Additionally, the ongoing shift from traditional healthcare to value-based care and remote patient monitoring is expected to benefit Medtronic’s diagnostic and monitoring devices.

Impact on Individuals

For individual investors, a strong earnings report from Medtronic could be a positive sign, indicating that the company is performing well and has a solid growth outlook. However, as with any investment, it’s important to consider the company’s financials, market position, and future prospects in the context of your personal investment strategy and risk tolerance.

Impact on the World

Medtronic’s strong earnings report is a testament to the growing demand for advanced healthcare technologies, particularly in the areas of cardiovascular care, diabetes management, and surgical procedures. As the global population ages and healthcare systems continue to evolve, companies like Medtronic will play a crucial role in addressing the increasing need for innovative medical solutions. Moreover, the trend towards remote patient monitoring and value-based care is expected to drive growth in the healthcare technology sector, with far-reaching implications for individuals, healthcare providers, and governments.

Conclusion

Medtronic’s strong third-quarter earnings report highlights the company’s robust financial performance and innovative product portfolio, positioning it well for continued growth in the healthcare technology sector. For individual investors, this report could be a positive sign, while for the world, it underscores the importance of advanced healthcare technologies in addressing the evolving needs of an aging population and the ongoing shift towards value-based care and remote patient monitoring.

Looking ahead, Medtronic’s focus on innovation, expanding product portfolio, and global market penetration will likely contribute to its continued success. As always, it’s important for investors to closely monitor the company’s financial performance and market trends when considering investment opportunities.

- Medtronic reported strong third-quarter earnings, with revenue growth of 12% year-over-year and earnings per share of $1.61, beating analysts’ estimates.

- The company’s net income increased by 19% year-over-year, reaching $1.5 billion.

- Management expressed confidence in the company’s ability to deliver strong financial performance for the remainder of the year and beyond.

- Medtronic’s stock price saw a modest increase following the earnings report but has since retreated to around $83 per share.

- The company’s focus on innovation, expanding product portfolio, and global market penetration will likely contribute to its continued growth.

- The trend towards remote patient monitoring and value-based care is expected to drive growth in the healthcare technology sector, with far-reaching implications for individuals, healthcare providers, and governments.