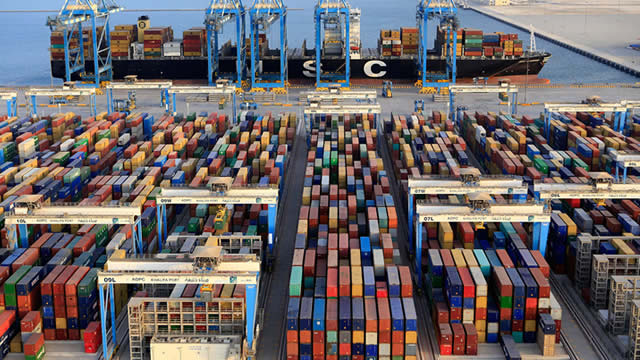

A Stormy Sea for Global Trade: The Impact of Geopolitical Tensions and Tariffs on Container Shipping

In the vast and intricately connected world of global trade, even the tiniest ripple can create a tsunami of consequences. Case in point: the world’s fifth-largest container line, Hapag-Lloyd, has recently announced its expectation of significantly lower earnings for the year. This news comes as no surprise, given the continued Middle East tensions and escalating trade disputes fueled by U.S. tariffs.

Middle East Tensions: A Perfect Storm for Uncertainty

The Middle East has long been a hotbed of geopolitical instability, but recent events have raised the stakes for global trade. Tensions between various regional powers, such as Iran and Saudi Arabia, have led to increased military presence and potential for conflict. This instability has resulted in the rerouting of shipping lanes, causing delays and higher costs for container lines like Hapag-Lloyd.

Trade Disputes: A Tariff-filled Sea of Challenges

The trade disputes between the U.S. and its major trading partners, including China, have created a tempest of uncertainty in the global shipping industry. With tariffs on billions of dollars’ worth of goods, importers and exporters have been forced to reconsider their shipping routes and strategies. This, in turn, has led to a decrease in demand for container shipping services, further impacting companies like Hapag-Lloyd.

Personal Impact: A Rough Ride for Consumers

The ripple effects of these geopolitical challenges and trade disputes extend far beyond the container shipping industry. As a consumer, you may notice higher prices for certain goods due to increased shipping costs and tariffs. Delays in shipping times could also lead to shortages of specific products, making it a challenging time for those relying on imports.

Global Impact: A Wave of Economic Consequences

The global economy could face significant consequences as a result of these ongoing challenges. Decreased demand for container shipping services could lead to job losses and financial instability for shipping companies. Furthermore, countries heavily reliant on exports, such as China, could experience economic downturns if demand for their goods decreases significantly.

Conclusion: Navigating the Choppy Waters of Global Trade

The world’s fifth-largest container line’s prediction of lower earnings is just one piece of evidence pointing to the challenging waters of global trade. Middle East tensions and escalating trade disputes, such as those between the U.S. and its trading partners, continue to create uncertainty and potential for significant impacts on container shipping and the global economy as a whole. As consumers, it’s essential to stay informed and adapt to these changes as best we can. After all, in the world of global trade, the only certainty is uncertainty.

- Middle East tensions result in rerouting of shipping lanes and increased costs for container lines.

- Trade disputes, such as those between the U.S. and China, decrease demand for container shipping services and lead to tariffs on goods.

- Personal impact: consumers may face higher prices and potential shortages of certain goods.

- Global impact: countries reliant on exports could experience economic downturns.