Newmont Corporation’s Stock Performance: A Closer Look

As the trading week came to a close, Newmont Corporation (NEM) saw a notable change in its stock price. The precious metals mining company ended the day at $47.81 per share, marking a 0.61% increase from the previous trading day.

Understanding the Impact on Investors

For investors holding Newmont Corporation stocks, this rise in value brings a sense of optimism. A 0.61% increase in just one day might not seem significant, but it’s essential to consider the larger trend. Over the past year, NEM’s stock has experienced a rollercoaster ride, with fluctuations driven by various factors such as gold prices, geopolitical tensions, and economic indicators.

Investors should keep a close eye on Newmont Corporation’s financial reports and industry news to gauge the company’s future performance. A positive earnings report, an uptick in gold prices, or favorable market conditions could lead to further growth for NEM’s stock. Conversely, negative news or economic downturns could result in a decline.

Global Implications

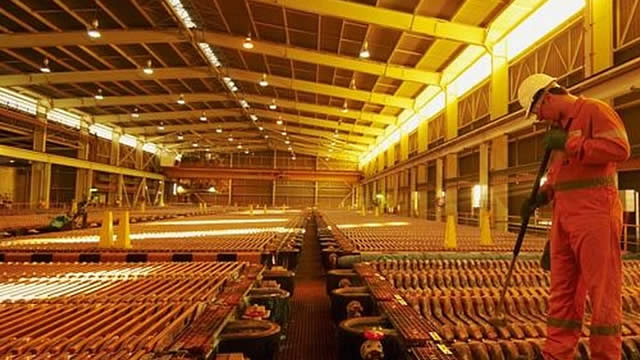

Beyond individual investors, the mining industry and the global economy can be influenced by Newmont Corporation’s stock performance. As one of the world’s leading gold producers, Newmont plays a significant role in the precious metals market. Gold is often seen as a safe-haven asset, meaning that when investors are uncertain about the economy or geopolitical situations, they tend to buy gold, driving up its price and, consequently, the stocks of mining companies like Newmont.

Moreover, Newmont Corporation’s operations span several countries, including the United States, Peru, and Ghana. Any changes in the company’s financial performance can have ripple effects on the economies of these countries, particularly those heavily reliant on mining for revenue. For instance, a strong Newmont Corporation could lead to increased government revenues and potential investments in infrastructure and social programs.

Looking Ahead

As we move forward, it’s crucial to stay informed about Newmont Corporation’s developments and the broader mining industry. While a single day’s stock price change might not tell the whole story, it can serve as a valuable indicator of the company’s overall health and the market conditions that may impact its future growth.

- Keep an eye on Newmont Corporation’s financial reports and earnings releases.

- Monitor gold prices and industry news.

- Stay updated on geopolitical and economic developments that could impact the mining sector.

By staying informed and keeping a long-term perspective, investors can make informed decisions and potentially benefit from Newmont Corporation’s future successes.

Conclusion

The recent 0.61% increase in Newmont Corporation’s stock price signals a positive trend for the precious metals mining company. For investors, this growth could mean potential gains, while for the global economy and countries with Newmont’s operations, the company’s financial health can have far-reaching implications. Keeping a close eye on Newmont Corporation’s developments and the mining industry as a whole is crucial for making informed decisions and staying ahead of the curve.