Southern Copper’s Latest Trading Session: A Closer Look

On the stock market front, Southern Copper Corporation (SCCO) recorded a noteworthy increase in its stock price during the latest trading session. The shares closed at $98.80, marking a daily uptick of 0.94%. Let’s delve deeper into this development and explore its possible implications.

Impact on Investors

For investors holding SCCO stocks, this positive movement could be seen as a promising sign, especially considering the recent market trends. The copper industry has been experiencing a resurgence due to the renewed demand for industrial metals, driven by the global economic recovery. This demand, coupled with supply constraints, has led to an upward trend in copper prices.

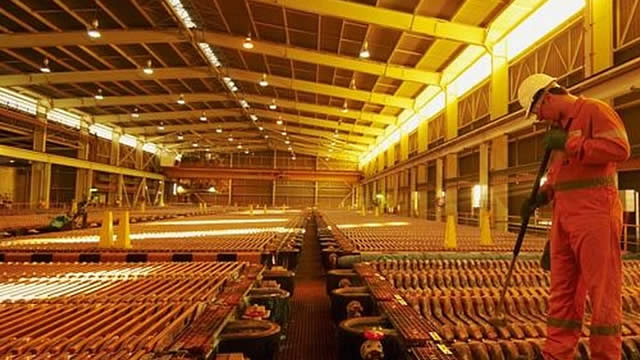

Moreover, Southern Copper’s strong operational performance and solid financial position have been key factors contributing to its stock price growth. The company’s extensive copper reserves and efficient mining operations enable it to capitalize on the current market conditions. As a result, investors who have been following the company closely or have recently entered the market may be reaping the benefits of their investment.

Global Impact

Beyond the realm of individual investors, Southern Copper’s stock price movement could have broader implications for the global economy. Copper is a crucial metal used in various industries, including construction, manufacturing, and electrical wiring. Its price fluctuations can significantly impact the costs and profitability of these sectors.

The ongoing demand for copper, coupled with the supply constraints, could lead to further price increases. This, in turn, could result in higher production costs for companies in the construction and manufacturing industries, potentially leading to increased prices for consumers. However, the positive economic conditions and the demand for copper could offset these cost pressures, contributing to overall economic growth.

Looking Ahead

As we move forward, Southern Copper’s performance will continue to be a key indicator of the copper market’s direction. The company’s operational efficiency, financial strength, and strategic initiatives will play a significant role in its ability to capitalize on the current market conditions. Furthermore, global economic trends, geopolitical developments, and supply-side factors will also influence the copper market and, consequently, Southern Copper’s stock price.

- Keep an eye on Southern Copper’s operational performance and financial results.

- Monitor global economic trends and geopolitical developments that could impact the copper market.

- Stay updated on any company-specific news and initiatives.

In conclusion, Southern Copper’s latest trading session, marked by a 0.94% increase in stock price, is an intriguing development in the context of the broader copper market. For investors, this positive movement could be a sign of things to come in the copper industry. Meanwhile, the global implications of this trend extend beyond the financial realm, with potential impacts on various industries and the overall economy.

As we look ahead, it is essential to keep a close eye on Southern Copper’s performance and the broader copper market. By staying informed and staying agile, investors can make informed decisions and capitalize on the opportunities that the market presents.