UBER’s Sideways Trading and the Road to Recovery

UBER’s stock has seen a rollercoaster ride since the beginning of 2022, with massive gains that left many investors in awe. However, the market’s enthusiasm cooled down in mid-2024, leading to a sideways trading pattern. This period of relative stability has been crucial for Uber, allowing the company to grow into its previously expensive valuations.

Cheaper Forward Valuations

One of the key factors contributing to Uber’s recovery is the cheaper forward valuations. The stock’s price-to-earnings ratio (P/E) has decreased significantly since the market correction in mid-2024. A lower P/E ratio means that investors are paying less for each dollar of Uber’s earnings, making the stock a more attractive investment.

Rich Profit Margins

Another factor that has helped Uber outperform is the improvement in its profit margins. The company has managed to increase its revenue per ride, as well as reduce its operating expenses. This has led to higher profit margins, which have made the stock more appealing to investors.

Healthier Balance Sheet

Lastly, Uber’s balance sheet has become healthier due to the sideways trading. The company has been using the calm market conditions to focus on debt reduction and cash flow improvement. A stronger balance sheet not only boosts investor confidence but also gives Uber the financial flexibility to make strategic investments.

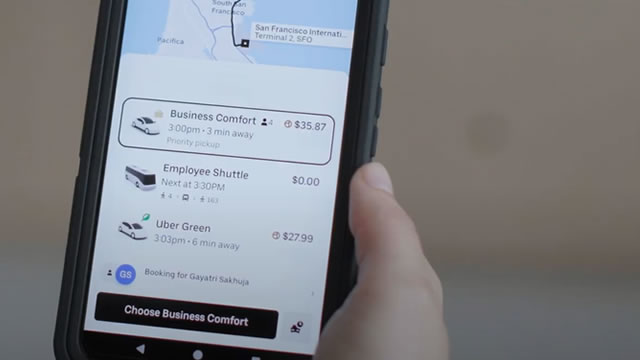

Impact on Individuals: Ride-Sharing Prices May Stabilize

For individual consumers, the sideways trading in Uber’s stock may lead to more stable ride-sharing prices. The company’s improved financial situation means that it can maintain its pricing strategy without the need for frequent adjustments. This could provide some relief for riders who have experienced price volatility in the past.

Impact on the World: Autonomous Taxis on the Horizon

On a larger scale, Uber’s sideways trading and financial recovery are significant because they allow the company to continue investing in autonomous taxi technology. Uber has already hinted at its ongoing efforts in Austin, Texas, where it plans to launch the Waymo robotaxi on its platform from March 2025 onwards. This development could revolutionize the transportation industry and have a profound impact on urban mobility.

Conclusion

UBER’s sideways trading since mid-2024 has been a double-edged sword. On one hand, it has allowed the company to recover from its previously expensive valuations by reducing forward valuations, improving profit margins, and strengthening its balance sheet. On the other hand, it has provided stability in ride-sharing prices for consumers. Looking ahead, Uber’s financial recovery is crucial for the development and implementation of autonomous taxis, which could transform the transportation industry.

- UBER’s sideways trading since mid-2024 has helped the company recover from its previously expensive valuations.

- Cheaper forward valuations, richer profit margins, and a healthier balance sheet have made Uber a more attractive investment.

- Individual consumers may benefit from more stable ride-sharing prices.

- Uber’s ongoing efforts in autonomous taxi technology could revolutionize the transportation industry.