Analyzing the Stock Performance of Axcelis Technologies (ACLS)

The latest trading day brought some noteworthy developments for Axcelis Technologies (ACLS), as the stock closed at $58.47, marking a 0.52% increase from its previous close.

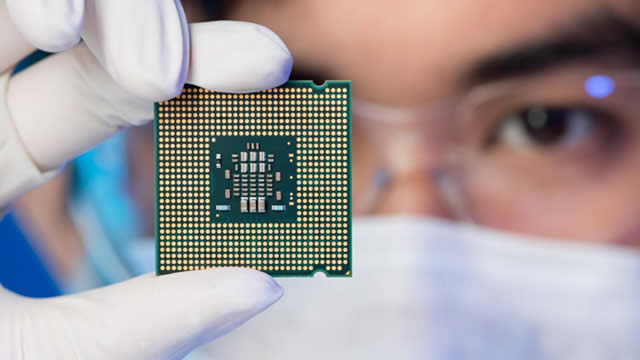

Background Information

Axcelis Technologies is a leading provider of semiconductor process solutions, including ion implantation systems, wafer processing solutions, and service offerings. These solutions are crucial for the production of semiconductor devices, which are essential components in various industries, including telecommunications, computing, and automotive.

Market Factors Affecting ACLS

Several factors contributed to the positive change in ACLS stock price. One significant factor is the ongoing semiconductor industry growth. The demand for semiconductors continues to rise due to the increasing adoption of technology in various sectors, such as automotive, healthcare, and telecommunications. This growth trend is expected to continue, as the global semiconductor market size is projected to reach $1,174.2 billion by 2028, growing at a CAGR of 8.4% from 2021 to 2028.

Impact on Individual Investors

For individual investors, the positive stock performance of ACLS presents an opportunity to capitalize on the growth trend in the semiconductor industry. By investing in ACLS, investors can potentially benefit from the increasing demand for semiconductors and the company’s role as a key supplier of solutions for semiconductor manufacturing.

Global Impact

On a global scale, the positive stock performance of ACLS can have several implications. First, it may attract more investors to the semiconductor industry, leading to increased capital inflows and further growth. Additionally, the positive stock performance can boost the morale of the workforce and management at Axcelis Technologies, potentially leading to increased innovation and productivity.

Market Analysis

Furthermore, the positive stock performance of ACLS can impact other semiconductor stocks, as investors may view this as a positive sign for the industry as a whole. This could lead to increased investor interest in other semiconductor stocks, potentially resulting in a broader market trend.

Investor Recommendations

For investors considering investing in ACLS, it is essential to conduct thorough research and assess the company’s financial health, growth prospects, and competitive positioning. Additionally, investors should consider diversifying their portfolio by investing in a mix of stocks, bonds, and other asset classes to minimize risk.

Conclusion

In conclusion, the positive stock performance of Axcelis Technologies (ACLS) on the latest trading day is an encouraging sign for the semiconductor industry and its investors. The ongoing growth trend in the semiconductor industry, coupled with ACLS’s role as a key supplier of solutions for semiconductor manufacturing, presents a potential opportunity for investors to capitalize on this trend. However, as with any investment, it is crucial to conduct thorough research and assess the risks involved.

- Axcelis Technologies (ACLS) closed at $58.47, representing a 0.52% increase from its previous close

- The semiconductor industry is experiencing significant growth due to the increasing adoption of technology in various sectors

- Positive stock performance of ACLS can attract more investors to the semiconductor industry and boost morale

- Investors should conduct thorough research before investing in ACLS or any other stock