Southern Copper’s Earnings Report: A Look Ahead

Thirty days have passed since Southern Copper Corporation (SCCO) released its latest earnings report, leaving investors and analysts pondering the future of this leading copper producer. Let’s delve deeper into the company’s performance and explore potential implications for both individual investors and the world at large.

Southern Copper’s Earnings Report Analysis

Southern Copper reported a net income of $324 million for the third quarter of 2021, marking a significant increase from the $101 million earned in the same period last year. The company’s revenue also grew by 35.9% year-over-year, reaching $2.3 billion. These impressive figures were driven by higher copper prices and increased production volumes.

Impact on Individual Investors

For individual investors, Southern Copper’s strong earnings report is likely to be a positive sign. The company’s solid financial performance and growing revenue indicate a healthy business that is well-positioned to continue thriving in the current market conditions. Additionally, the increasing demand for copper due to the global energy transition towards renewable sources and the ongoing infrastructure development in emerging economies could further boost the stock’s value.

Impact on the World

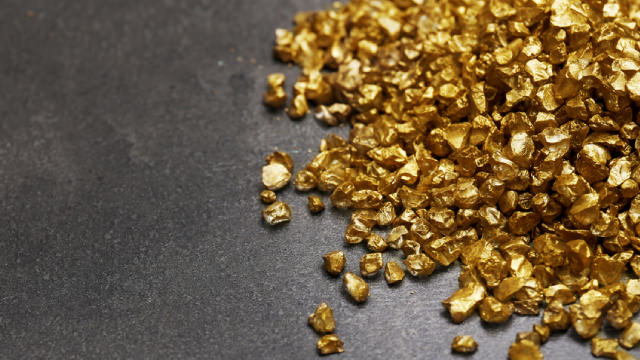

On a broader scale, Southern Copper’s earnings report underscores the importance of the copper industry in the global economy. Copper is a vital commodity used in various sectors, including construction, manufacturing, and renewable energy. The strong earnings from Southern Copper and other major copper producers suggest a robust copper market, which could lead to increased investments in copper mining and production projects. This, in turn, could contribute to economic growth and job creation, particularly in countries with significant copper reserves.

Future Outlook

Looking ahead, several factors could influence the future of Southern Copper’s stock. These include ongoing supply and demand dynamics in the copper market, geopolitical risks, and the company’s ability to effectively manage its operations and capitalize on growth opportunities. As a responsible investor, it’s essential to closely monitor these factors and stay informed about any developments that could impact Southern Copper’s financial performance and stock price.

Conclusion

Southern Copper’s strong earnings report highlights the company’s resilience and growth potential in the current market conditions. For individual investors, this could mean a promising opportunity for capital appreciation. On a global scale, Southern Copper’s performance underscores the importance of the copper industry in driving economic growth and supporting the transition towards a more sustainable energy future. As always, it’s crucial to stay informed and make investment decisions based on thorough research and analysis.

- Southern Copper reported impressive earnings for Q3 2021, with a net income of $324 million and revenue of $2.3 billion.

- The company’s financial performance was driven by higher copper prices and increased production volumes.

- Strong earnings from Southern Copper and other major copper producers suggest a robust copper market, which could lead to increased investments in copper mining and production projects.

- Individual investors may find attractive opportunities for capital appreciation in Southern Copper’s stock.

- The copper industry’s importance in the global economy underscores the potential for economic growth and job creation, particularly in countries with significant copper reserves.