Barrick Gold’s Recent Earnings Report: What’s Next for the Stock?

Barrick Gold Corporation (GOLD), one of the world’s largest gold mining companies, reported its earnings for the third quarter on October 13, 2021. The report revealed a 36% increase in profits compared to the same period last year, driven by higher gold prices and strong operational performance. But now that the numbers have been crunched, what’s next for Barrick Gold stock?

A Closer Look at Barrick Gold’s Earnings

Barrick Gold reported adjusted earnings of $0.24 per share, beating analysts’ estimates by $0.05. The company’s revenue came in at $4.1 billion, also surpassing expectations. The strong earnings report was a result of several factors:

- Higher gold prices: Gold prices have been on a tear in 2021, reaching record highs above $1,800 per ounce. Barrick Gold’s revenue benefited significantly from this price increase.

- Operational efficiency: Barrick Gold’s operational efficiency improved in the third quarter, with all-in sustaining costs (AISC) coming in at $947 per ounce, a 12% decrease compared to the same period last year.

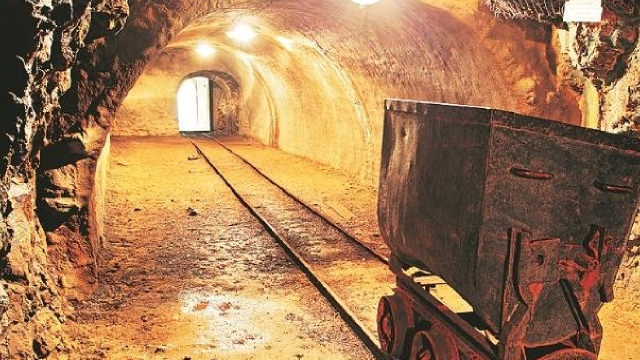

- Strategic acquisitions: Barrick Gold’s acquisition of Randgold Resources in 2018 has proved to be a game-changer. The deal added several high-quality gold mines to Barrick’s portfolio, contributing to the company’s strong performance.

Impact on Barrick Gold Stock

Following the earnings report, Barrick Gold’s stock price experienced a modest increase, rising by around 2%. However, some analysts believe that the stock is still undervalued, given the company’s strong operational performance and the continued strength of the gold market.

One analyst noted, “Barrick Gold’s Q3 results demonstrate the company’s ability to generate strong cash flow, even in a volatile gold price environment. With a solid balance sheet and a disciplined approach to capital allocation, we believe Barrick Gold is well-positioned to continue generating value for shareholders.”

Impact on the World

Barrick Gold’s strong earnings report is not just good news for the company and its shareholders. It also has implications for the global gold market and the economies that rely on gold production:

- Higher gold prices: As Barrick Gold and other gold producers report strong earnings, gold prices are likely to remain high, benefiting other gold miners and countries with significant gold reserves.

- Economic stability: Gold is often seen as a safe haven asset, and its strong performance can provide a buffer against economic instability. As such, Barrick Gold’s earnings report could help to bolster investor confidence and stabilize financial markets.

- Environmental concerns: However, Barrick Gold’s strong performance comes with environmental concerns. The company’s mining operations can have significant impacts on local communities and ecosystems, and there are ongoing debates about the sustainability of gold mining as an industry.

Conclusion

Barrick Gold’s strong third-quarter earnings report is a positive sign for the company and the gold market. With gold prices remaining high and operational efficiency improving, Barrick Gold is well-positioned to continue generating strong cash flow. However, the company’s success comes with environmental concerns, and it will be important for Barrick Gold and the gold mining industry as a whole to address these issues in a sustainable way.

For individual investors, Barrick Gold’s earnings report may signal an opportunity to invest in the stock, given its strong operational performance and the continued strength of the gold market. However, as with any investment, it’s important to do your own research and consider the risks involved.

From a global perspective, Barrick Gold’s earnings report could help to stabilize financial markets and provide a buffer against economic instability. However, it also highlights the need for sustainable mining practices and responsible resource management.