Eaton Corporation (ETN): Insights and Impacts

Eaton Corporation (ETN) has been generating significant buzz among investors, and it’s essential to stay informed about this industrial powerhouse. Zacks.com, a leading investment research firm, has highlighted ETN, making it a stock worth watching.

Company Overview

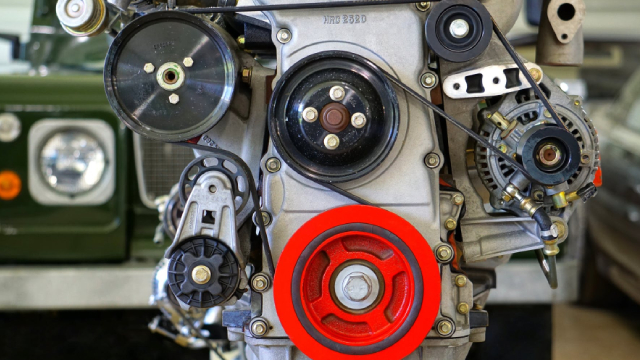

Eaton Corporation is a power management company that provides energy-efficient solutions for electrical, hydraulic, and mechanical power distribution. The company operates in five business segments: Electrical, Hydraulics, Aerospace, Vehicle, and Energy Management. ETN’s products and services are essential in various industries, including transportation, construction, energy, and manufacturing.

Financial Performance

ETN has reported impressive financial results in recent quarters, with revenue growing steadily. In the third quarter of 2021, the company reported a 16% increase in revenue compared to the same period in 2020. The earnings per share (EPS) also grew by 23% year-over-year. These figures indicate a robust financial position, which is a positive sign for investors.

Industry Trends

The industrial sector, particularly the power management segment, is witnessing several trends that could impact ETN’s performance. These trends include:

- Electrification: The shift towards electric vehicles (EVs) and renewable energy sources is driving demand for power management solutions. Eaton is well-positioned to capitalize on this trend, given its broad portfolio of products and services.

- Digitalization: The increasing adoption of digital technologies in industrial applications is another trend that could benefit Eaton. The company’s focus on smart technologies and the Internet of Things (IoT) could help it gain a competitive edge.

- Regulatory Compliance: Increasing regulatory requirements for energy efficiency and emissions reduction could create opportunities for Eaton. The company’s focus on sustainable energy solutions positions it well to meet these demands.

Impact on Individual Investors

For individual investors, the attention from Zacks.com and ETN’s strong financial performance and industry trends suggest that the stock could be a good investment opportunity. However, it’s essential to consider risk factors, such as market volatility and geopolitical tensions, that could impact the stock’s price.

Impact on the World

From a global perspective, Eaton’s role in providing power management solutions is essential for various industries and applications. The company’s focus on sustainability and digitalization could contribute to a more efficient, connected, and eco-friendly world. Additionally, the electrification trend could lead to a reduction in greenhouse gas emissions and a shift towards renewable energy sources.

Conclusion

In conclusion, Eaton Corporation (ETN) is an industrial powerhouse with a robust financial position and a strong focus on industry trends. The attention from Zacks.com is a positive sign for investors, but it’s essential to consider risk factors and keep abreast of market developments. ETN’s role in providing power management solutions is essential for various industries and applications, and its focus on sustainability and digitalization could contribute to a more efficient, connected, and eco-friendly world. Stay informed and make investment decisions wisely.