The Slight Dip in Texas Instruments (TXN) Stock: A Closer Look

In the bustling world of stocks and shares, every trading session brings new surprises. And in the most recent one, Texas Instruments Inc. (TXN) took a small but noticeable hit. So, what’s the deal with this dip, and what could it mean for you and the world at large? Let’s dive in and find out, shall we?

A Closer Look at the Trading Session

First things first, let’s revisit the numbers: Texas Instruments closed at $173.60 in the most recent trading session, marking a -1.2% shift from the previous trading day. Now, this may not seem like a lot, but in the stock market, even the smallest percentage changes can have significant ripple effects.

The Impact on Individuals: A Personal Perspective

If you’re an individual investor, a 1.2% dip in TXN stock might not make or break your portfolio. But it’s still worth keeping an eye on. Why, you ask? Well, think of the stock market as a giant, ever-shifting puzzle. Each piece represents a company’s stock, and when one piece moves, it can affect the positioning of other pieces. In this case, a dip in TXN stock could potentially impact other tech stocks or even the broader market.

The Impact on the World: A Bigger Picture

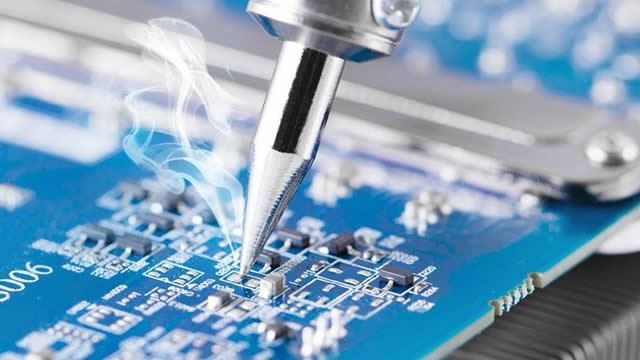

Now, let’s take a step back and consider the bigger picture. Texas Instruments is a leading global semiconductor design and manufacturing company. Its products are used in a wide range of applications, from automotive and industrial to communications and consumer electronics. A dip in TXN stock could indicate investor uncertainty about the company’s financial health or broader market trends. This, in turn, could impact companies that rely on TXN for their semiconductor needs and, ultimately, the consumers who use their products.

What’s Next?

The stock market is an ever-changing beast, and it’s impossible to predict with certainty what will happen next. But rest assured, we’ll be keeping a close eye on TXN and the broader market. In the meantime, remember that investing always comes with risks. But with a little patience, research, and a healthy dose of humor, we can navigate even the most turbulent markets.

In Conclusion: A Lighthearted Take

So there you have it, folks. Texas Instruments took a tiny tumble in the most recent trading session. But don’t panic! Remember, even the mightiest of giants can have off days. And who among us hasn’t had one of those? Let’s give TXN a little time to bounce back, and in the meantime, let’s keep calm and carry on with our investing adventures. After all, life is too short for stock market stress!

- Texas Instruments (TXN) closed at $173.60 in the most recent trading session, marking a -1.2% shift from the previous trading day.

- Individual investors may not be significantly impacted by this dip, but it’s still worth keeping an eye on.

- The bigger picture: a dip in TXN stock could impact companies that rely on it for semiconductors and ultimately, consumers.

- The stock market is an ever-changing beast, but with patience, research, and a sense of humor, we can navigate even the most turbulent markets.