Broadcom’s Resilience Amidst Recession Fears: A Closer Look

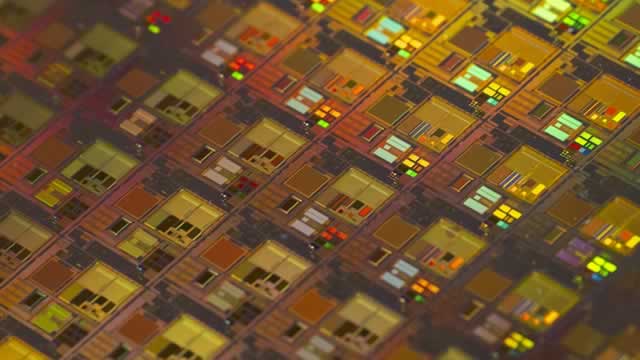

Broadcom, a leading semiconductor company, has recently reported strong financial results for Q1 of their fiscal year 2023, with sales growing by an impressive 25% to reach $14.9 billion. This growth can be attributed to two key areas: Artificial Intelligence (AI) revenues and infrastructure sales.

Strong Performance in a Sluggish Non-AI Environment

The increase in AI revenues is a clear indication of Broadcom’s strategic focus on this high-growth area. The company’s AI business has been gaining momentum, driven by the increasing adoption of AI technologies across various industries. This trend is expected to continue, as businesses continue to invest in AI to enhance their operations and gain a competitive edge.

Moreover, Broadcom’s infrastructure sales have also contributed significantly to its strong Q1 performance. Infrastructure sales include components used in data centers, telecommunications networks, and other large-scale IT systems. Despite potential negative demand trends in a soft market, Broadcom’s infrastructure sales have remained robust. This can be partly attributed to the company’s long-term contracts with key customers, which provide a degree of shielding from recession fears.

Significant Growth Prospects Beyond Current Recession Concerns

Looking ahead, Broadcom’s market potential is estimated to be between $60-$90 billion over the next fiscal year, with three hyperscaler customers being a significant contributor to this growth. Hyperscalers are large cloud computing companies that operate at scale, and Broadcom’s relationship with these customers is a testament to the company’s ability to deliver high-performance, reliable, and cost-effective solutions.

Impact on Consumers and the World

For consumers, Broadcom’s strong financial performance and growth prospects are positive signs. Broadcom’s products are used in a wide range of consumer electronics, from smartphones and laptops to home appliances and automobiles. As Broadcom continues to innovate and expand its offerings, consumers can expect new and improved products that offer better performance, lower power consumption, and increased functionality.

At a global level, Broadcom’s growth is also a positive indicator for the semiconductor industry as a whole. The semiconductor industry is a key driver of innovation and economic growth, and Broadcom’s success is a reflection of the industry’s ability to adapt and thrive in a rapidly changing technological landscape.

Conclusion

In conclusion, Broadcom’s strong Q1 financial performance and significant growth prospects are a testament to the company’s strategic focus on high-growth areas such as AI and infrastructure. Broadcom’s ability to deliver high-performance, reliable, and cost-effective solutions to its customers, including hyperscalers, has positioned the company well for future growth. Consumers and the world can look forward to new and improved products that leverage the latest technologies, while the semiconductor industry can take heart from Broadcom’s success as a bellwether for the industry’s potential.

- Broadcom reports strong Q1 sales growth of 25% to $14.9 billion

- Growth driven by AI revenues and infrastructure sales

- Market potential estimated to be between $60-$90 billion over the next fiscal year

- Three hyperscaler customers expected to contribute significantly to growth

- Positive signs for consumers and the semiconductor industry