Miller Industries’ Disappointing Q4 2024 Results: A Look into the Impact

In the final quarter of 2024, Miller Industries reported financial results that fell short of investor expectations. The company experienced a decline in revenue and earnings, leading to a significant stock drop, with a 15% decrease from the previous day and a 30% year-to-date decline.

Financial Performance

Although net income grew by 9% year-over-year (YoY), profitability is projected to decrease in 2025. The earnings per share (EPS) guidance was revised down from $6 to $3 per share.

Driving Factors

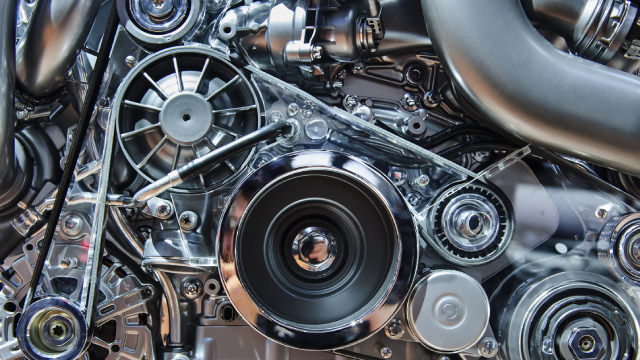

Miller Industries’ growth has been fueled by an increasing number of vehicles on the road, more frequent vehicle breakdowns, and rising car crash rates. The demand for the company’s tow trucks and roadside assistance services is likely to continue due to these trends.

Impact on Individual Investors

The disappointing financial results have left many investors questioning the future of Miller Industries. Those who held the stock for the long term may be considering whether to hold or sell, while new investors may be hesitant to enter the market. It is essential for individual investors to closely monitor the company’s financial reports and industry trends before making any decisions.

- Consider the long-term growth potential of the company and the industry

- Analyze the company’s financial reports and future projections

- Keep an eye on industry trends and competitors

Impact on the World

The decline in Miller Industries’ stock price may have ripple effects on the broader market. Reduced investor confidence in the company could lead to a decrease in overall market liquidity, potentially impacting other industries and stocks. Additionally, the demand for tow trucks and roadside assistance services is a reflection of the increasing number of vehicles on the road and the likelihood of breakdowns and crashes. As the global population continues to grow and urbanization increases, the need for these services is expected to remain strong.

Conclusion

Miller Industries’ Q4 2024 financial results were a disappointment, with lower revenue and earnings leading to a significant stock drop. While profitability is projected to decrease in 2025, the long-term growth potential of the company and the industry remains strong due to the increasing number of vehicles on the road and the likelihood of breakdowns and crashes. Individual investors should closely monitor the company’s financial reports and industry trends before making any decisions.

The decline in Miller Industries’ stock price may have broader implications for the market, but the demand for tow trucks and roadside assistance services is expected to remain strong. As the world continues to urbanize and the number of vehicles on the road increases, the need for these services is likely to grow.