Charles Schwab Corp (SCHW): Navigating Economic Uncertainty and Persistent Selling Pressure

The financial sector is experiencing a significant downturn, with major bank stocks, including Charles Schwab Corp (SCHW), feeling the brunt of the sell-off. This trend is driven by a combination of economic uncertainty and persistent selling pressure.

Economic Uncertainty

Economic uncertainty is a major factor contributing to the recent sell-off in the financial sector. Global economic growth has slowed down, and there are growing concerns about a potential recession. The ongoing trade tensions between the United States and China, coupled with geopolitical risks, have added to the uncertainty.

Persistent Selling Pressure

Persistent selling pressure in the financial sector is another factor driving the sell-off in Charles Schwab Corp (SCHW) and other major bank stocks. Investors have been selling off stocks in the sector due to concerns about rising interest rates and the potential impact on earnings.

Impact on Individuals

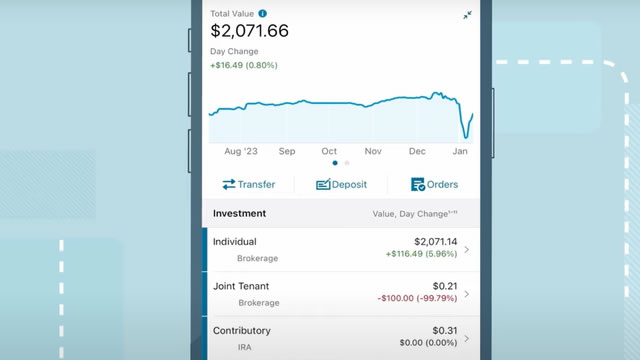

For individuals, the sell-off in Charles Schwab Corp (SCHW) and other major bank stocks could have several implications. If you have investments in these stocks, you may experience a decline in the value of your portfolio. Additionally, if you have a mortgage or other debt, rising interest rates could increase your monthly payments.

- Decline in portfolio value: If you have investments in Charles Schwab Corp (SCHW) or other major bank stocks, you may experience a decline in the value of your portfolio.

- Impact on borrowing costs: Rising interest rates could increase the cost of borrowing for individuals, making it more expensive to take out a mortgage or other loans.

Impact on the World

The sell-off in Charles Schwab Corp (SCHW) and other major bank stocks could have significant implications for the global economy. The financial sector is a major contributor to economic growth, and a sell-off in bank stocks could lead to a decrease in lending and a slowdown in economic activity.

- Decrease in lending: A sell-off in bank stocks could lead to a decrease in lending, as banks may be less willing to extend credit due to concerns about their own financial health.

- Slowdown in economic activity: A decrease in lending could lead to a slowdown in economic activity, as businesses and consumers may be less able to obtain the credit they need to grow and expand.

Conclusion

The sell-off in Charles Schwab Corp (SCHW) and other major bank stocks is a reminder of the economic uncertainty and persistent selling pressure that is currently impacting the financial sector. For individuals, this could mean a decline in the value of their portfolios and an increase in borrowing costs. For the world, it could mean a decrease in lending and a slowdown in economic activity. It is important for individuals to stay informed about the economic environment and to consider diversifying their portfolios to mitigate risk.

As always, it is recommended to consult with a financial advisor for personalized advice and recommendations.