Oracle’s Earnings: A Closer Look

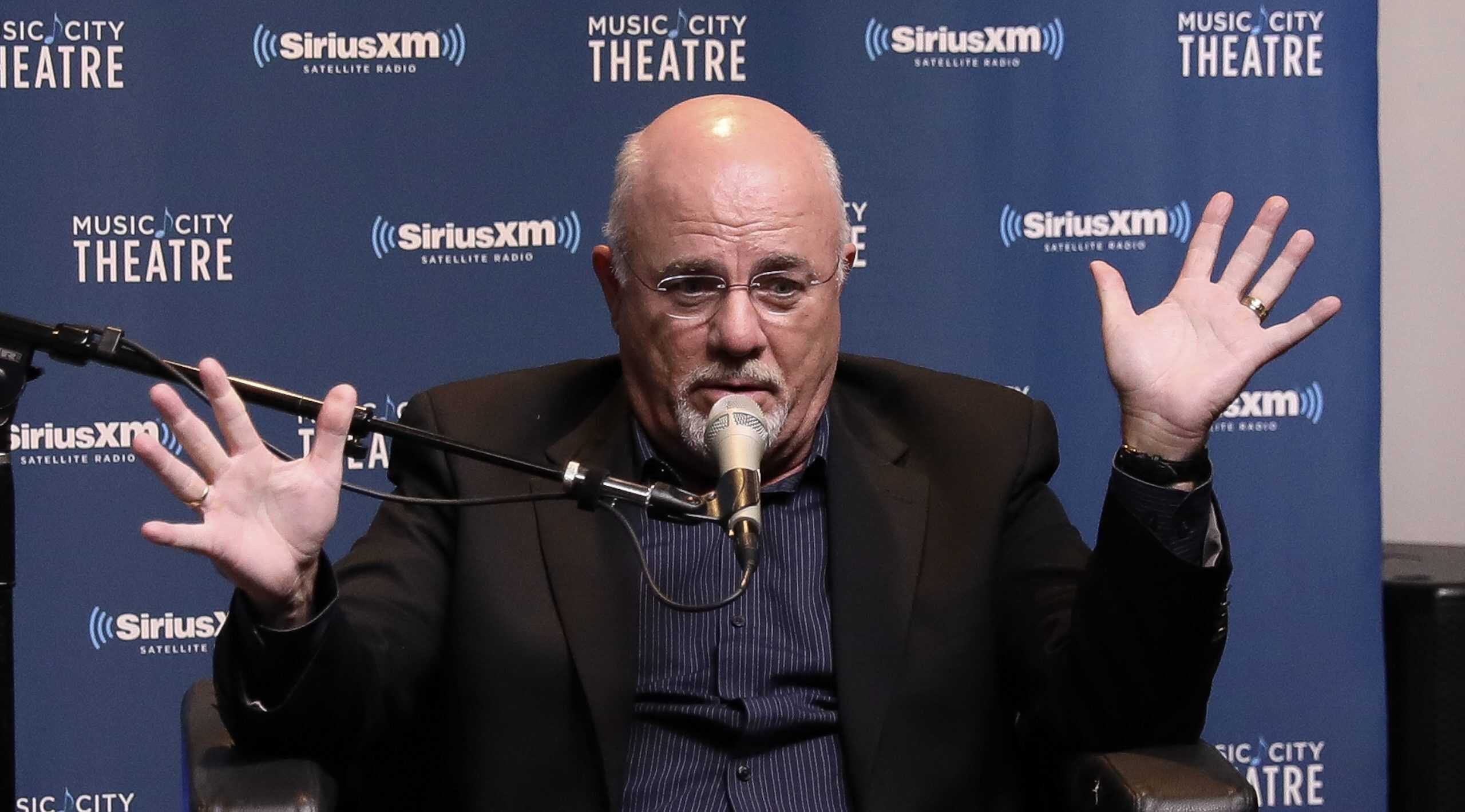

Angelo Zino, a well-respected equity analyst at CFRA Research, recently shared his perspective on Oracle Corporation (ORCL)’s upcoming earnings report. According to Zino, the tech giant’s earnings “should be fine.” While this statement may seem ambiguous, it’s essential to delve deeper into Zino’s reasoning and the potential implications for investors and the broader technology industry.

Key Areas of Focus

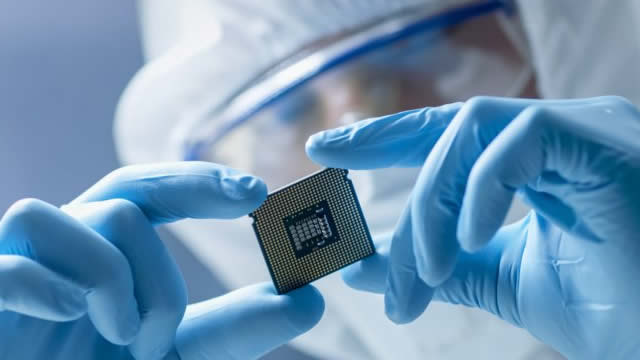

When Oracle reports its fiscal Q3 2023 earnings on February 16, 2023, investors will be closely watching the company’s outlook, particularly regarding compute demand. This interest stems from the ongoing semiconductor shortage and the potential impact it may have on Oracle’s hardware business.

Compute Demand

Compute demand, which refers to the demand for processing power, is an essential factor in the tech industry. Oracle derives a significant portion of its revenue from hardware systems, including servers and engineered systems. The semiconductor shortage has disrupted the supply chain, leading to increased prices and longer delivery times for these products.

As a result, investors will be keen to understand Oracle’s strategy for addressing the semiconductor shortage and its potential impact on the company’s hardware business. Zino believes that Oracle has been proactive in managing its supply chain and may have already secured sufficient inventory to mitigate the effects of the shortage.

Supply and Demand

Beyond compute demand, investors will also be paying close attention to Oracle’s overall supply and demand dynamics. The company’s cloud business, which is a significant growth driver, has been performing well. However, there are concerns that the economic downturn may impact the demand for cloud services.

Oracle’s earnings report will provide insight into the current state of its cloud business, including growth rates and any potential headwinds. Additionally, the company’s fiscal Q3 2023 guidance will give investors a sense of the future outlook for both the cloud and hardware businesses.

Implications for Investors

For investors, Oracle’s earnings report is an opportunity to reassess their position in the stock. A strong earnings report, particularly with positive guidance, could lead to a price increase. Conversely, a weak report could result in a sell-off. As such, investors should be prepared for potential volatility following the earnings release.

Implications for the World

Beyond the immediate impact on Oracle’s stock price, the company’s earnings report could have broader implications for the technology industry. A strong showing from Oracle’s cloud business would be a positive sign for the sector, as it would indicate continued growth in the cloud market. Conversely, a weak report could signal broader economic concerns, potentially impacting other tech companies.

Conclusion

Oracle’s upcoming earnings report is an essential event for investors, as it will provide insight into the company’s financial performance and future outlook. Key areas of focus include compute demand, supply and demand dynamics, and the overall health of the cloud business. A strong report could lead to a price increase for Oracle’s stock, while a weak report could signal broader economic concerns. Regardless of the outcome, the earnings report will provide valuable insight into the current state of the technology industry.

- Angelo Zino, a CFRA Research analyst, believes Oracle’s earnings “should be fine.”

- Investors will focus on Oracle’s outlook, particularly regarding compute demand and supply and demand dynamics.

- Oracle’s hardware business, which includes servers and engineered systems, may be impacted by the semiconductor shortage.

- The company’s cloud business, a significant growth driver, will also be closely watched.

- A strong earnings report could lead to a price increase for Oracle’s stock, while a weak report could signal broader economic concerns.