Nvidia Corporation: Bullish Growth Prospects Amidst Challenges

Nvidia Corporation (NVDA), a leading technology company known for its graphics processing units (GPUs) and system on a chip units (SoCs), has been making headlines with its robust revenue growth and strategic initiatives. In its recent earnings call for the fourth quarter of fiscal 2022 (FY22), NVDA reported healthy revenue growth, driven by strong demand from its gaming, data center, and professional visualization segments.

Revenue Growth: A Healthy Sign

Revenue for the gaming segment grew by 14.2% year-over-year (YoY) to $1.9 billion, data center revenue grew by 30.3% YoY to $4.7 billion, and professional visualization revenue increased by 10.4% YoY to $307 million. The combined revenue for these three segments amounted to $6.9 billion, representing a 28.2% increase YoY.

Stargate Demand: A 3.2% Growth Increment

One of the significant contributors to this growth was the demand for Nvidia’s Hopper architecture GPUs for data centers, mainly driven by the Stargate supercomputer at Oak Ridge National Laboratory. This demand boosted Nvidia’s data center segment, resulting in a 3.2% increase in revenue growth.

Encouraging Growth Signals from a Key Supplier

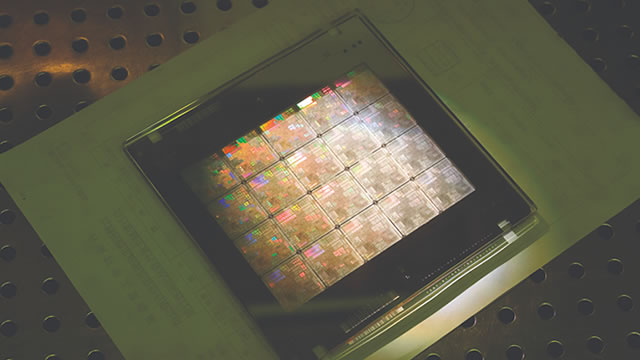

Furthermore, Taiwan Semiconductor Manufacturing Company (TSMC), a major supplier for Nvidia, reported healthy demand for its 5nm and 7nm chips, which are used in Nvidia’s GPUs and SoCs. This demand indicates continued strong demand for Nvidia’s products, as they heavily rely on TSMC’s manufacturing capabilities.

Gross Margins: A Temporary Dip

Despite these positive signs, Nvidia’s management guided for a gross margin dip of almost 300 basis points (bps) in the first quarter of FY26. This dip is attributed to the company’s shift towards less profitable product lines, such as its entry-level GPUs for the gaming market. However, management assures investors that gross margins would rebound back toward the mid-70s later in the fiscal year.

TSMC’s Avoidance of Tariffs: A Silver Lining

Another factor contributing to NVDA’s growth prospects is TSMC’s successful avoidance of hefty tariffs. As a result, Nvidia’s products, which are manufactured using TSMC’s chips, have been exempted from the US-China trade war tariffs. This exemption allows Nvidia to maintain its competitive edge in the market.

Rising Receivable Days: A Concern

However, there are concerns regarding Nvidia’s rising receivable days, which have increased by approximately 30 days YoY. This trend indicates a deterioration in cash flow and may negatively impact free cash flow (FCF) margins. Furthermore, tariff risks remain a concern, as any potential increase in tariffs could negatively impact Nvidia’s gross margins and overall profitability.

Impact on Consumers

- Strong demand for Nvidia’s GPUs and SoCs could lead to increased prices for consumers in the gaming, data center, and professional visualization markets.

- Increased competition from AMD and Intel could result in more affordable alternatives for consumers.

Impact on the World

- Continued innovation in AI and deep learning technologies will drive demand for Nvidia’s GPUs and SoCs, contributing to the growth of these markets.

- Increased adoption of Nvidia’s technologies in various industries, such as automotive, healthcare, and finance, could lead to significant advancements and improvements.

- Potential trade tensions between the US and China could impact Nvidia’s profitability and growth, potentially leading to increased prices for consumers and businesses worldwide.

Conclusion

In conclusion, Nvidia Corporation’s robust revenue growth, driven by strong demand for its GPUs and SoCs, provides a bullish outlook for the company’s future prospects. Despite temporary gross margin concerns and potential tariff risks, Nvidia’s strategic initiatives, such as its focus on AI and deep learning technologies, position it well for continued success in the technology industry. Additionally, the impact of Nvidia’s growth extends beyond its consumer base, as its innovations contribute to advancements in various industries and markets.

For consumers, this growth could lead to increased prices for Nvidia’s products, but it also means that they will have access to the latest and most advanced technologies. For the world, Nvidia’s innovations could lead to significant advancements in various industries and markets, ultimately driving progress and growth.