Do Wall Street Analysts’ Recommendations Really Matter?

In the bustling world of stocks and securities, investors often find themselves at a crossroads when making decisions about their portfolios. Should they buy, sell, or hold a particular stock? Enter the stage: Wall Street analysts, those brokerage-firm employees with the power to sway markets with a single rating change.

The Analyst’s Influence

It’s no secret that media reports about rating changes made by these sell-side analysts can cause a ripple effect in the stock market. A simple upgrade or downgrade can send a stock’s price soaring or plummeting, making it a crucial piece of information for investors.

But Do They Really Matter?

While the immediate impact of an analyst’s recommendation on a stock’s price is undeniable, the question remains: do these recommendations truly hold any long-term significance? Some argue that they do, citing the influence these analysts wield over institutional investors and the general public.

- Institutional Investors: Large investment firms and pension funds often follow the lead of Wall Street analysts, making their recommendations a powerful catalyst for buying or selling large volumes of stock.

- Public Perception: The media coverage surrounding an analyst’s recommendation can influence the general public’s perception of a stock, affecting individual investors’ decisions.

However, others contend that the impact of analysts’ recommendations is overhyped. They argue that the stock market is influenced by a multitude of factors, and the recommendations themselves are often based on incomplete or biased information.

The Analyst’s Motives

One reason for this skepticism is the potential conflict of interest inherent in the role of a sell-side analyst. These analysts are employed by brokerage firms that earn commissions on every trade made by their clients. This creates an incentive for them to issue recommendations that will generate more trading activity, rather than providing unbiased advice.

The Impact on You

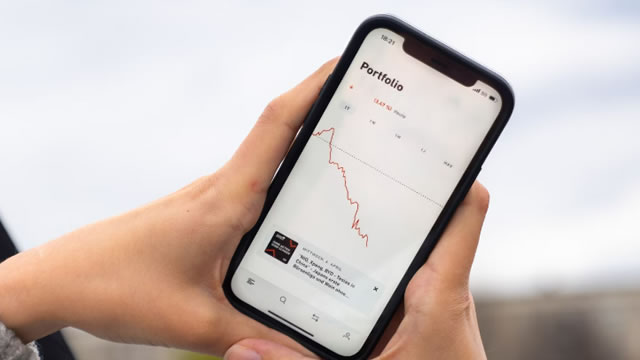

As an individual investor, the impact of Wall Street analysts’ recommendations on your personal portfolio can be significant. However, it’s essential to remember that these recommendations should not be the sole basis for your investment decisions. Instead, consider conducting your own research and analysis, and use the recommendations as just one piece of the puzzle.

The Impact on the World

On a larger scale, the influence of Wall Street analysts on the stock market can have far-reaching consequences. Rapid price fluctuations driven by recommendations can create market volatility, potentially leading to economic instability. It’s crucial that investors, both institutional and individual, approach these recommendations with a healthy dose of skepticism and make informed decisions based on their own research.

Conclusion

So, do Wall Street analysts’ recommendations really matter? The answer is yes, but only to a certain extent. While they can have a significant impact on a stock’s price in the short term, it’s essential to remember that they should not be the sole basis for your investment decisions. Instead, take the recommendations with a grain of salt, conduct your own research, and make informed decisions based on your unique financial situation and goals.

And to the Wall Street analysts out there, keep in mind that your recommendations carry a great deal of weight. Use that power wisely, and remember that your ultimate goal should be to provide unbiased, accurate, and valuable information to help investors make informed decisions.