A Bizarre Financial Dilemma: Paying Parents’ Mortgage vs. Securing Your Own Financial Future

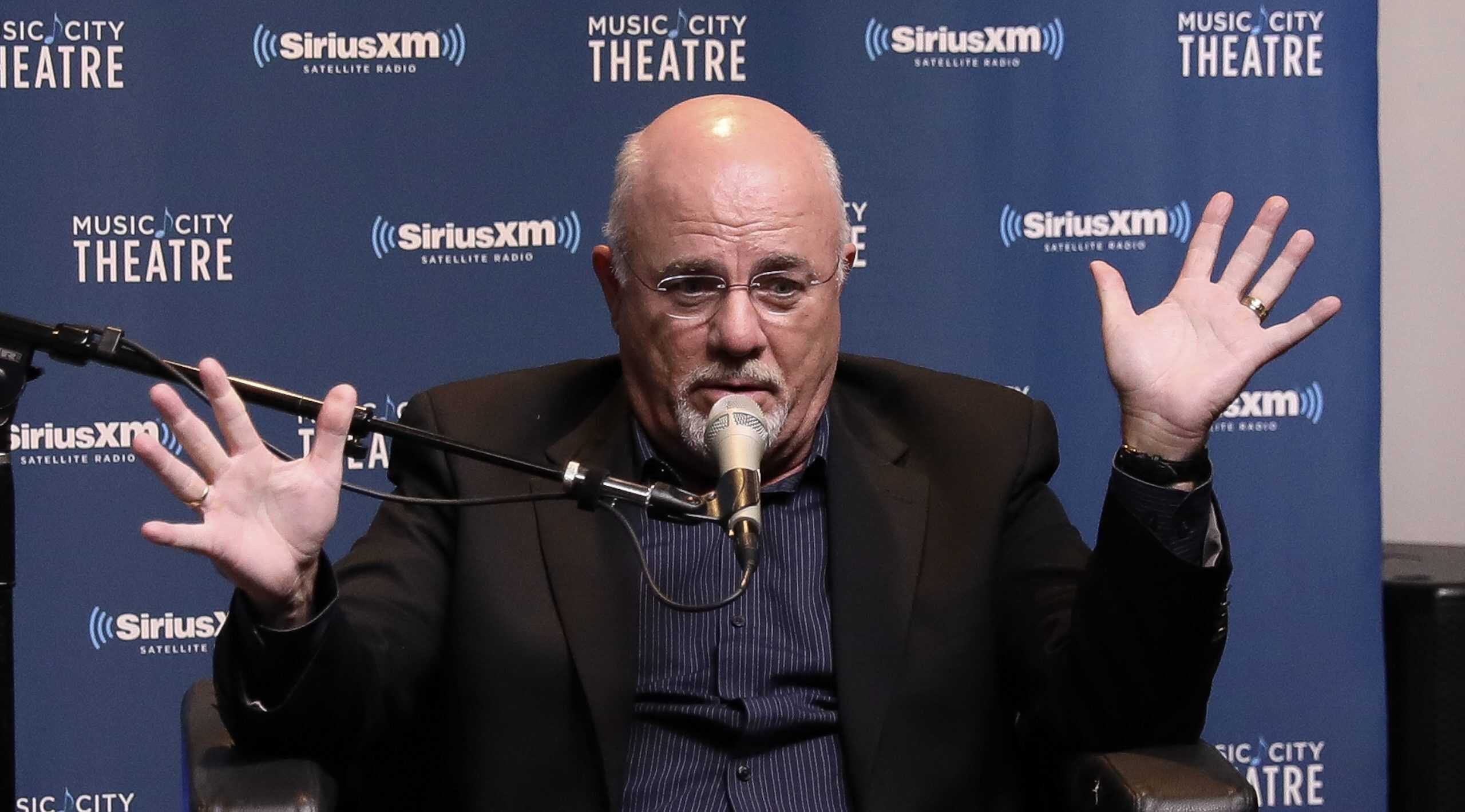

Every so often, financial situations arise that leave us scratching our heads and questioning the rationality of certain financial decisions. One such peculiar case was recently discussed on the Dave Ramsey show, involving a 29-year-old individual who pays $3,000 per month towards their parents’ mortgage. While it might seem noble to help parents retire in comfort, there are potential consequences that could jeopardize the 29-year-old’s own financial wellbeing and retirement savings.

Setting Clear Financial Boundaries

Dave Ramsey emphasizes the importance of setting clear financial boundaries with family, and rightfully so. The 29-year-old’s situation raises several concerns. Are they ahead or behind on their retirement? SmartAsset’s free tool can help you answer that question and connect you with a financial advisor to help you get on track.

Financial Priorities: Parents or Self?

The 29-year-old’s decision to pay their parents’ mortgage might seem like a selfless act, but it could potentially set them back financially. With their own financial journey just beginning, it’s crucial to prioritize their own expenses and savings. Ramsey sees the Millennial as “enabling” financially irresponsible behavior, and I couldn’t agree more.

The Importance of Early Retirement

If the parents are retired early, it’s essential to consider whether their retirement had anything to do with their child’s financial contributions. The 29-year-old should encourage their parents to reconsider their retirement plans and consider returning to work to pay off their mortgage. This confrontation can be challenging, but it’s essential to ensure that both generations are financially secure.

The Millennial Sandwich Generation

As Millennials approach the “sandwich generation,” supporting aging parents and raising children, financial priorities become even more crucial. It’s essential to ensure that you’re not becoming a source of cash flows for your parents in bad times and good. The “bank of mom and dad” makes more sense than the “bank of one’s child,” especially when parents are financially better off.

Consequences for the Individual

Paying the parents’ mortgage while neglecting your own financial goals can lead to significant consequences. Delaying retirement savings, debt repayment, and homeownership can result in missed opportunities and a less secure financial future. It’s vital to prioritize your financial needs and set clear boundaries with family.

Global Implications

The consequences of this financial situation extend beyond the individual. The trend of relying on children to support their parents’ retirement could have far-reaching implications for the economy and social structure. Governments and policymakers must consider ways to address this issue and support multiple generations in securing their financial futures.

Conclusion

While lending a helping hand to family members can be a kind and noble gesture, it’s essential to understand the potential consequences. Delaying your own financial goals to support a parent’s retirement can lead to missed opportunities and a less secure future. It’s crucial to set clear financial priorities and boundaries, ensuring that both generations are financially secure. Remember, putting your oxygen mask on first is essential before helping others.

- Setting clear financial boundaries with family is essential.

- Paying parents’ mortgage could jeopardize your financial future.

- Encouraging parents to reconsider retirement plans can help both parties.

- The “bank of mom and dad” can have far-reaching implications for the economy and social structure.