The Impact of Trade Wars on Tech Stocks: A Closer Look

The stock market has experienced a significant downturn in recent times, with fears of a looming trade war taking center stage. This economic uncertainty has led to a sell-off in nearly every sector, but none have been hit harder than the big tech leaders that have thrived due to the rise of artificial intelligence (AI).

The Tech Sector’s Role in the Economy

Tech companies have long been a driving force in the U.S. economy. Their innovative products and services have transformed industries and created new ones, leading to job growth and economic prosperity. However, the tech sector’s outsized role in the economy also makes it a prime target in trade disputes.

The Impact on Tech Stocks

The tech-heavy Nasdaq Composite Index has taken a hit, with many big tech stocks experiencing significant declines. For instance, Apple Inc. (AAPL) and Microsoft Corporation (MSFT) have seen their stocks drop by over 10% since the trade tensions escalated. Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOGL), the parent company of Google, have also felt the pinch, with their stocks down by around 7% and 5%, respectively.

The Reasons Behind the Declines

The tech sector’s vulnerability to trade wars can be attributed to several factors. One significant reason is the sector’s heavy reliance on global supply chains. Tech companies source components and raw materials from various countries, including China, which could be impacted by tariffs. Moreover, these companies sell their products worldwide, making them susceptible to import taxes in various markets.

The Effects on Consumers and Investors

The declines in tech stocks could have far-reaching consequences for consumers and investors. For consumers, the potential rise in prices for tech products due to tariffs could make them less affordable. For investors, a prolonged downturn in the tech sector could negatively impact their portfolios.

The Global Implications

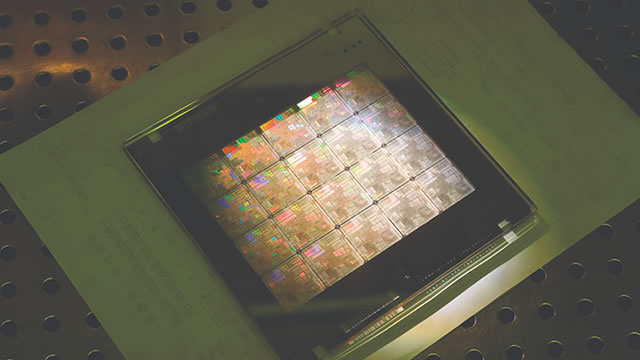

The trade war’s impact on tech stocks is not limited to the U.S. market. Global economies are interconnected, and the ripple effects of the trade tensions could be felt in various markets. For instance, Taiwan Semiconductor Manufacturing Company (TSM), the world’s largest contract chipmaker, has seen its stock price drop by over 15% due to the trade war fears. The company supplies chips to many tech giants, including Apple and Qualcomm, making it a crucial player in the tech sector.

The Road Ahead

The current trade tensions between the U.S. and China are far from resolved. The outcome of the ongoing negotiations could significantly impact the tech sector and the broader economy. Investors are advised to stay informed and closely monitor the situation.

- Keep an eye on trade negotiations between the U.S. and China.

- Stay updated on the impact of tariffs on tech companies’ supply chains and sales.

- Consider diversifying your portfolio to mitigate risk.

Conclusion

The recent sell-off in tech stocks is a reminder of the sector’s vulnerability to trade wars and the broader economic uncertainty they bring. As the trade tensions between the U.S. and China continue to unfold, investors must remain vigilant and adapt to the changing landscape. By staying informed and taking a proactive approach, investors can navigate the challenges and potentially capitalize on opportunities in the tech sector.