Exploring Momentum Investing: Is Ameren (AEE) a Top Pick?

Momentum investing has emerged as a popular strategy among stock market enthusiasts. This approach involves identifying stocks that have shown strong price momentum and buying them with the expectation that the trend will continue. One such stock that has caught the attention of momentum investors is Ameren Corporation (AEE). Let’s delve deeper into Ameren’s financial performance and growth prospects to determine if it’s a worthy addition to a momentum investor’s portfolio.

Financial Performance

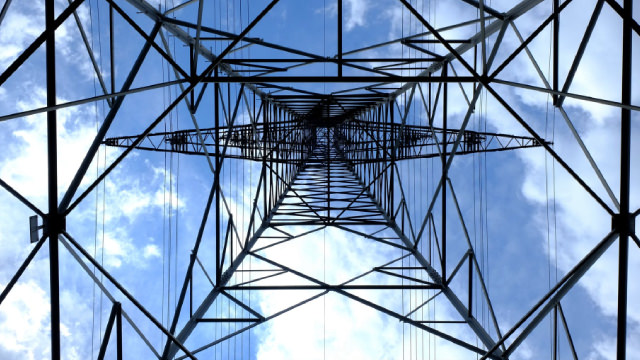

Ameren is a leading electric and natural gas utility company based in the United States. The company reported strong financial results for the third quarter of 2021. Its net income increased by 23% compared to the same period last year, reaching $672 million. Ameren’s revenue also grew by 7% to $2.8 billion. These numbers indicate a solid financial foundation for the company.

Growth Prospects

Beyond its current financial performance, Ameren boasts several growth drivers that make it an attractive pick for momentum investors. One such driver is its regulated utility business, which is expected to provide stable, predictable earnings through rate-regulated returns on investments. Additionally, Ameren is investing in infrastructure upgrades to modernize its grid and enhance its reliability, which should lead to increased revenue and customer satisfaction.

Dividend

Another factor that momentum investors may find appealing is Ameren’s dividend. The company has a long history of paying dividends and has increased its payout for 29 consecutive years. This consistency makes Ameren an attractive option for income-focused investors as well.

Impact on Individuals

For individual investors, a potential investment in Ameren could offer several benefits. First, as a momentum stock, there is the potential for significant price appreciation if the stock continues to trend upwards. Additionally, the company’s stable financial performance, growth prospects, and consistent dividend make it an attractive long-term holding. However, as with any investment, there is also the risk of potential losses if the stock’s momentum reverses.

Impact on the World

On a larger scale, Ameren’s growth and success could have a positive impact on the world. The company’s investments in grid modernization and infrastructure upgrades will lead to a more reliable and efficient energy grid, which is crucial for powering modern society. Furthermore, as a leader in the utility industry, Ameren’s success could inspire other companies to follow its lead and invest in similar projects, leading to a more sustainable and efficient energy future for all.

Conclusion

In conclusion, Ameren Corporation (AEE) presents a compelling case for momentum investors. Its strong financial performance, growth prospects, and consistent dividend make it a solid long-term holding. For individuals, investing in Ameren could offer the potential for significant price appreciation and a steady income stream. On a larger scale, Ameren’s success could lead to a more reliable and efficient energy grid, benefiting society as a whole. However, as with any investment, it’s important to carefully consider the risks and potential rewards before making a decision.

- Ameren Corporation reported strong financial results for Q3 2021, with net income up 23% and revenue up 7%.

- The company’s regulated utility business and infrastructure upgrades provide a solid foundation for future growth.

- Ameren has paid dividends for 29 consecutive years and is a consistent income generator.

- For individuals, investing in Ameren could offer potential price appreciation and a steady income stream.

- Ameren’s success could lead to a more reliable and efficient energy grid, benefiting society as a whole.