Broadcom’s Q1 Earnings: A Surprise Boost for AI Hardware Investors

In a delightfully unexpected turn of events, Broadcom Inc. (AVGO) sent shockwaves through the tech industry after reporting impressive first-quarter earnings that surpassed expectations. The stock soared by an astounding 13% post-market, making it the talk of the town among investors.

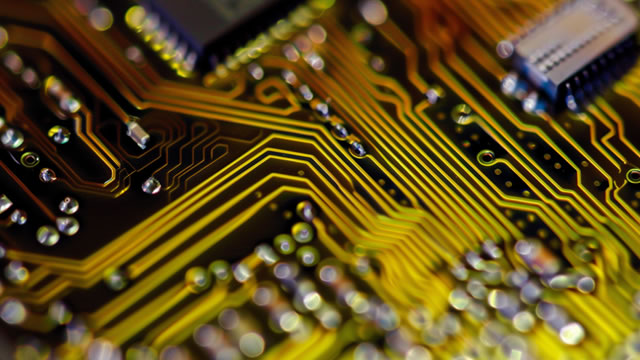

Strong Demand for AI Hardware

The primary catalyst for Broadcom’s stellar performance was the robust demand for AI hardware. With the ever-growing importance of artificial intelligence in our modern world, companies like Broadcom are reaping the benefits of being at the forefront of this technological revolution. The company’s strong partnership with tech giants like Apple (AAPL) further bolsters its position in the sector.

Financial Health and Improving Margins

Broadcom reported a 25% year-over-year increase in revenue and a staggering 28% free cash flow growth. These numbers indicate not only financial health but also improving margins for the company. Such impressive financial performance is a testament to Broadcom’s ability to adapt to the changing technological landscape and capitalize on emerging trends.

Personal Impact

If you’re an investor in the tech sector, particularly in the AI hardware space, Broadcom’s Q1 earnings report is a reason to celebrate. The company’s strong financial performance and growing partnerships make it an attractive long-term investment. Moreover, as more industries adopt AI technology, the demand for high-performance hardware is expected to rise, which could lead to further growth for Broadcom.

Global Implications

Broadcom’s impressive earnings report isn’t just good news for investors; it also has far-reaching implications for the global economy. The strong demand for AI hardware is driving innovation and technological advancements across various industries, from healthcare and finance to manufacturing and transportation. As a result, we can expect to see continued growth in the tech sector and a host of new applications for AI technology.

Conclusion

In a world where technology is constantly evolving, it’s essential to keep a close eye on companies like Broadcom that are at the forefront of innovation. Their impressive Q1 earnings report, driven by strong demand for AI hardware and growing partnerships, make it a solid long-term investment. Moreover, the global implications of this trend are vast, as AI technology continues to revolutionize industries and drive economic growth. So, keep calm and invest on, fellow tech enthusiasts!

- Broadcom reports impressive Q1 earnings, with revenue and free cash flow growth exceeding expectations

- Strong demand for AI hardware is the primary driver of Broadcom’s success

- Partnership with Apple further solidifies Broadcom’s position in the AI hardware sector

- Financial health and improving margins indicate a bright future for the company

- Investors in the tech sector, particularly in the AI hardware space, should take note of Broadcom’s performance

- The global implications of this trend are vast, with continued growth expected in the tech sector and new applications for AI technology