Comparing KLA and ACI Worldwide’s Performance in 2023: A Detailed Analysis

In the ever-evolving world of technology and finance, keeping track of key players in specific sectors can be a daunting task. Two such companies that have grabbed the attention of investors this year are KLA Corporation (KLAC) and ACI Worldwide (ACIW). Let’s delve into their performance and compare it to their respective sectors.

KLA Corporation (KLAC): A Glimpse into Their Year

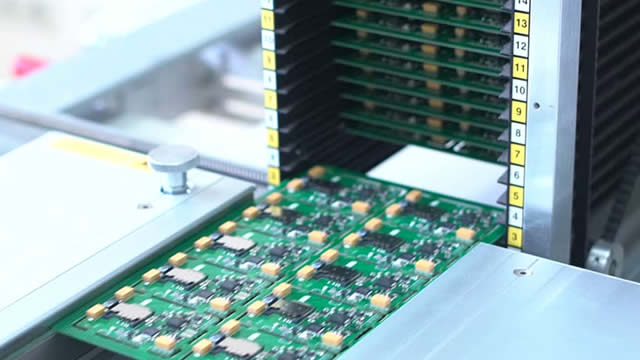

KLA Corporation is a leading provider of advanced semiconductor equipment and services. Their solutions are essential for the development, manufacture, and delivery of new technologies for a variety of industries. As of now, KLA’s stock price has seen a steady rise, up by approximately 25% year-to-date (YTD).

Analyzing KLA’s Sector Performance

The semiconductor sector, where KLA operates, has been on a rollercoaster ride this year. The sector’s growth is primarily driven by the increasing demand for electronics in various industries, including automotive, consumer electronics, and industrial automation. According to industry reports, the semiconductor sector is projected to grow by around 14% in 2023.

ACI Worldwide (ACIW): A Look at Their Performance

ACI Worldwide is a leading global provider of real-time electronic payment and banking solutions. Their solutions help financial institutions, corporations, and retailers process and manage digital payments. As of now, ACIW’s stock price has experienced a significant increase of around 35% YTD.

Exploring ACI Worldwide’s Sector Performance

The payments sector, where ACI Worldwide operates, is also experiencing growth. The shift towards digital payments and contactless transactions, driven by the COVID-19 pandemic, has accelerated the adoption of electronic payment solutions. Industry reports suggest that the electronic payment market is expected to grow by around 16% in 2023.

Impact on Individuals: An Opportunity or a Challenge?

For investors: Both KLA and ACI Worldwide’s strong performance in their respective sectors could mean potential gains. However, it’s important to remember that investing always comes with risks. It is advisable to conduct thorough research and consider consulting a financial advisor before making investment decisions.

Impact on the World: A New Era of Technology

For the world: The strong performance of KLA and ACI Worldwide is a testament to the growing importance of technology in various industries. The semiconductor and payments sectors are key drivers of innovation and economic growth. As these sectors continue to evolve, we can expect to see new technologies and solutions that will reshape the way we live, work, and interact.

Conclusion

In summary, KLA Corporation and ACI Worldwide have shown impressive growth in their respective sectors this year. Their strong performance is indicative of the growing importance of technology in various industries, particularly semiconductors and payments. For investors, this presents an opportunity to potentially gain from these sectors’ growth. For the world, it signifies a new era of innovation and technological advancements that will shape our future.

- KLA Corporation: A leading provider of advanced semiconductor equipment and services, with a YTD stock price increase of around 25%.

- ACI Worldwide: A leading global provider of real-time electronic payment and banking solutions, with a YTD stock price increase of around 35%.

- The semiconductor sector is projected to grow by around 14% in 2023, driven by the increasing demand for electronics.

- The electronic payment market is expected to grow by around 16% in 2023, driven by the shift towards digital payments.