Melrose Industries Plc: A Profitable Year and Future Prospects

Shares of Melrose Industries Plc (MRO, MLSPF) witnessed a significant drop of 8% to 624.8p on Thursday, despite the company reporting profits for the year 2024 that surpassed expectations. The aerospace parts manufacturer announced revenue of £3.5 billion, representing an impressive Year-on-Year (YoY) growth of 11%, and operating profits that soared by 42% to £540 million.

Financial Highlights

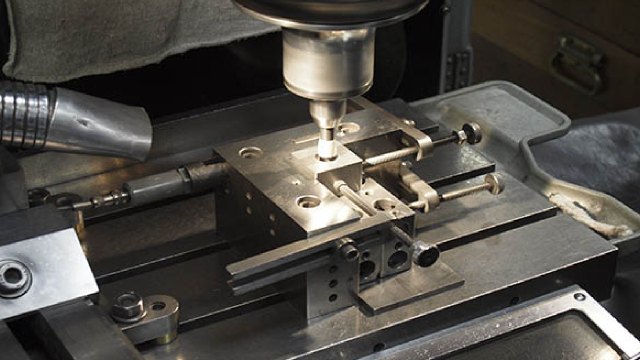

The impressive financial performance was driven by the strong demand for aerospace parts, which is a critical component in the aviation industry’s recovery from the pandemic. The company’s net debt also decreased by £1.4 billion, reflecting its ongoing commitment to deleveraging.

Future Prospects

Melrose Industries’ CEO, Simon Peckham, expressed optimism about the future, predicting a “step change” in the company’s cash generation in the years ahead. He attributed this to the ongoing recovery of the aerospace sector and the company’s focus on operational excellence.

Impact on Individual Investors

The share price decline may be a cause for concern for individual investors who have recently purchased Melrose Industries shares, as they may be looking at a paper loss. However, the company’s strong financial performance and positive outlook for the future could provide an opportunity for long-term investors to consider purchasing shares at a lower price.

Impact on the Aerospace Industry and the Economy

Melrose Industries’ strong financial performance is a positive sign for the aerospace industry, which has been hit hard by the pandemic. The sector’s recovery is crucial for the global economy, as it is a significant contributor to Gross Domestic Product (GDP) in many countries, including the United States and Europe.

Moreover, the aerospace sector’s recovery is likely to have a ripple effect on other industries, such as manufacturing, logistics, and tourism, which are closely linked to the sector. This, in turn, could lead to increased economic activity and job creation.

Conclusion

Melrose Industries Plc’s strong financial performance for the year 2024, coupled with its optimistic outlook for the future, is a positive sign for the aerospace industry and the global economy. While individual investors may be disappointed with the recent share price decline, the company’s financial strength and positive future prospects could provide an opportunity for long-term investment. The ongoing recovery of the aerospace sector is crucial for the economic recovery of many countries and the creation of new jobs.

- Melrose Industries Plc reported profits for the year 2024 at the top end of expectations

- Revenue came in at £3.5 billion, up 11% YoY

- Operating profits up 42% to £540 million

- Net debt decreased by £1.4 billion

- CEO predicted a “step change” in cash generation in the years ahead

- Strong financial performance is a positive sign for the aerospace industry and the global economy

- Ongoing recovery of the aerospace sector is crucial for the economic recovery and job creation